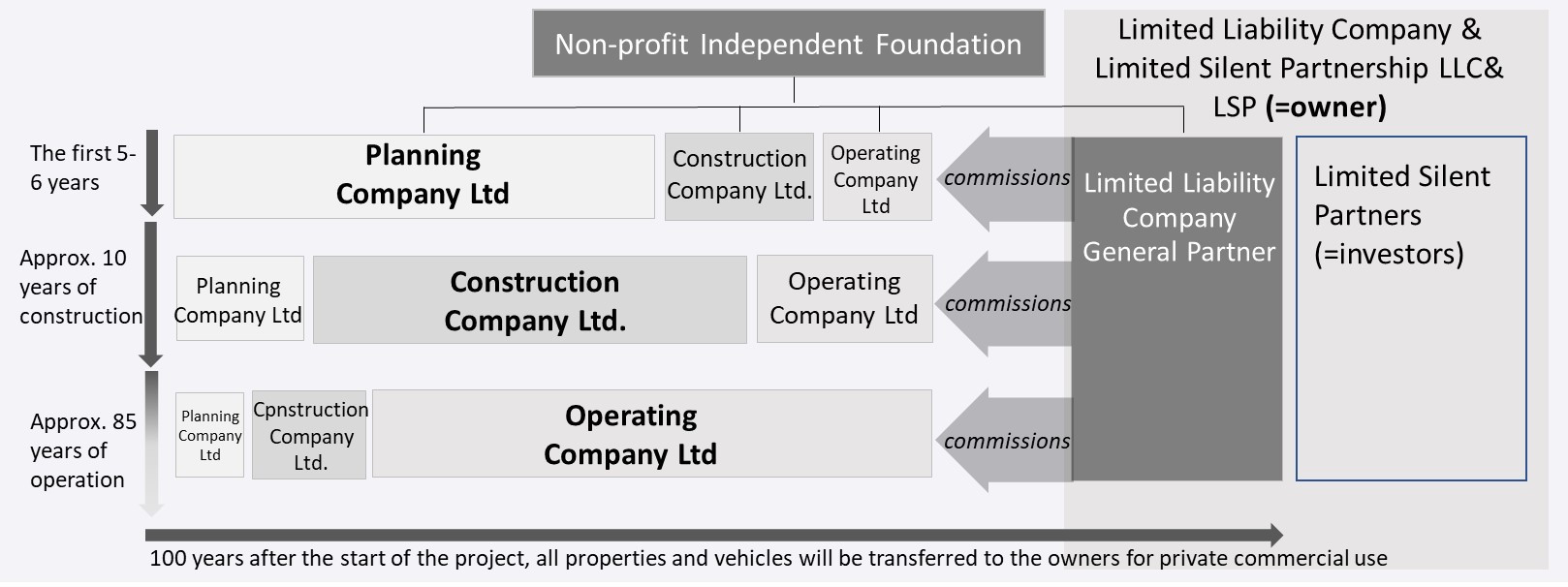

Under corporate law, non-profit limited liability companies are intended to be the executive actors for the first 100 years

The executive bodies for the entire infrastructure project are non-profit limited liability companies (gGmbH), all of which are subsidiaries of a non-profit foundation under civil law. The non-profit status ensures that overarching social goals are pursued in the planning, construction and operation of the Frankfurt Bridges. This increases public acceptance and thus the chances and speed of implementation.

Both the foundation's purposes and the non-profit purposes of the gGmbH actors also serve to make the implementation of the infrastructure project transparent and to protect it against deterioration in quality.

Overall, the aim is to create a congruence of interests between investors on the one hand and the social, environmental and cultural goals of the general public on the other - as an example for other large infrastructure projects in Germany. This innovative approach can serve as an example for the further development of conventional public-private partnership concepts.

Since the investors represent economic interests and the management units are to operate with non-profit alignment, the legal form of the “CoKG” (i.e. Limited Liability Company & Limited Silent Partnership) is suitable

Even though the construction of the Frankfurt Bridges in the first 100 years is an infrastructure project with high social and cultural standards as well as a clear prioritization of sustainability, no public funding is planned: This would, on the one hand, entail the obligation to issue a public tender in accordance with European tendering law, which could slow down the project and make its implementation more expensive; on the other hand, it would be a burden on taxpayers, which would make the Frankfurt Bridges a political issue, with politicians at city, state and federal level obliged to represent the interests of their electorate in setting priorities and designing the Frankfurt Bridges accordingly, i.e. usually against the interests of voters of other parties - which could also cause project implementation to stagnate. Therefore, all investors come from the private sector.

But especially when investors are from the private sector, it is particularly important to ensure that the management during planning, construction and operation is committed to the social and environmental goals that the project primarily has. Therefore, every operating entity responsible for implementing the project should have a non-profit legal form.

The interests of investors are even protected in the Frankfurt Bridges by the fact that, or precisely because, non-profit management prevails in the planning, construction and operation of the Frankfurt Bridges, for the following reasons

- Their planning is particularly long-term and therefore quality-oriented

- They can be built on high acceptance among the population, which massively accelerates project implementation

- A particularly attractive design is ensured, which initially benefits the beneficiaries of the first 85 years of operation, i.e. the general public and tourism, but subsequently also benefits investors, because attractively designed goods achieve a higher value or greater demand than poorly designed goods - even after 100 years (as can be seen in magnificent buildings from the 19th century or pre-war buildings from the 20th century, which are still among the most sought-after properties in the world today, or in vintage cars, which - if well preserved - are often exorbitantly expensive).

How can the capital interests of investors and the non-profit nature of the bridge planners, builders and operators be combined under corporate law?

The Frankfurt Bridges are to be financed by private sector investors (and not by state or public institutions, in order to carry out the entire project as quickly and efficiently as possible). The investors will put their money into a corporation whose profits are subject to tax.

The companies carrying out the project (for planning, construction, operation), on the other hand, are to be structured as non-profit gGmbHs (in order to implement the Frankfurt Bridges in a completely transparent manner and in the interests of the citizens and the public sector). A non-profit legal entity, however, pursues its non-profit purposes selflessly, directly and exclusively and is thus tax-privileged or tax-exempt.

In order to distinguish between actors and investors, the GmbH & CoKG company form (i.e. Limited Liability Company & Limited Silent Partnership) is a good option. However, the non-profit companies that are founded as Ltd companies to implement projects cannot be directly involved as general partners in a private corporation into which the investors put their money, as this would mean they would lose their non-profit character.

The non-profit Ltd companies can be linked to the Limited Liability Company & Limited Silent Partnership via an (also non-profit) uniting parent company, in which a non-profit 100% sister company of them acts as a general partner in the LLC&LSP

A non-profit foundation is the 100% parent company of all three non-profit Ltd companies: the Planning Company according to HOAI, the Construction Company and the Operating Company. It also has a 100% stake in a Ltd company, which is a general partner and takes on the role of “personally liable partner” of a Limited Liability Company & Limited Silent Partnership, into which the investors contribute money. This subsidiary of the non-profit foundation, acting as a general partner, is consequently not tax-privileged in Germany.

A non-profit foundation must pursue its non-profit purpose selflessly, directly and exclusively. The exclusivity feature becomes a problem in the case of a direct shareholding in a LLC&LSP, since non-profit activity in the form of a shareholding is usually excluded in Germany. However, this is not harmful if the non-profit foundation’s subsidiary, the personally liable partner (also called general partner) has asset management for the mother foundation as its task and business content; this does not endanger the non-profit status of the mother company.

The participation of a non-profit foundation in a corporation is usually assigned to this tax-free asset management. This only does not apply if the non-profit foundation actually exercises a decisive influence on the day-to-day management of the corporation (unless this corporation is itself tax-privileged or solely manages assets). A decisive influence on the day-to-day management is therefore not assumed if the foundation merely exercises its statutory shareholder rights and obligations.

The shareholders' agreements must reflect this accordingly, as there is no active intervention in day-to-day business, as the shareholders' meeting of a Ltd. only has real influence on day-to-day business if it assumes original management rights. However, if the shareholders' meeting draws up a catalogue of legal transactions for the implementation of which the management requires the approval of either the shareholders' meeting itself or another body, the persollay liable partner Ltd (liable with its assets, only, though) can ensure that only exceptional measures are subject to the approval requirement and not those of the day-to-day management.

In this case, the task of the foundation subsidiary/personally liable partner/general partner is limited to the awarding of contracts to the non-profit sister companies (also daughters of the mother foundation) that implement the Frankfurt Brides on behalf of the the LLC&LSP

The LLC&LSP is the best form of company for distinguishing between private investors and non-profit management

If one puts together the components “investors from the private sector who are not supposed to act in management” and “management actors who are supposed to act for the benefit of the public”, a suitable company form is a LLC&LSP with conventional limited partners and a general partner who is a subsidiary of a non-profit foundation.

The general partner is a Ltd company with only 2 people, as it has only one function: commissioning contracts for the planning, construction and operation of the Frankfurt Bridges to its non-profit Ltd sister companies, which vary in size depending on the project phase. The Ltd company acting as general partner may not itself be a non-profit company, as it must act in the economic interests of the limited silent partners and this would counteract its non-profit status.

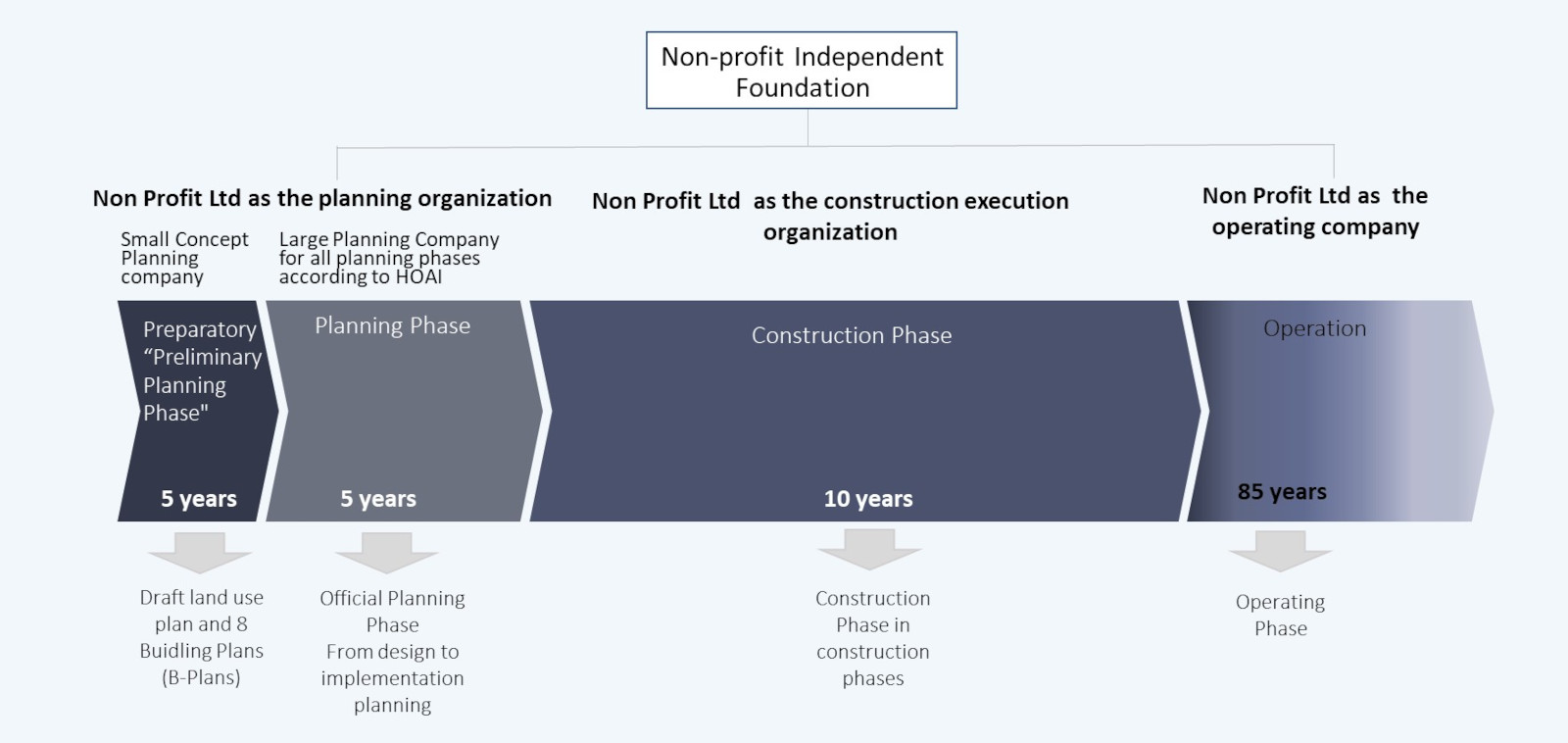

Following public relations work by the Altes Neuland Frankfurt Foundation, other newly founded non-profit management companies will take over and implement the infrastructure project for 100 years – for long-term investing owners

The small non-profit “Concept Planning Company Ltd” in the preliminary phase of the actual planning works with limited resources and is designed to be lean so as not to arouse the desires of so-called “professional neighbours”

The small Concept Planning Company only has permanent employees of managing directors and experts for steering management - all reports, drawings, analyses, etc. are outsourced. If too much money has already been invested in the planning before the eight development plans are approved, the risk increases that residents will abuse the pressure to implement these plans that then come with high investments to make unreasonably high demands for minor impairments - knowing full well that without their consent or if they take legal action against the project, the investors would lose a lot of money. Accordingly, the best solution is not to invest so much money in advance, but to concentrate exclusively on important neighbourly issues such as drawing a concept for compensating for actually justified impairments to residents or preventing trees from being endangered by the construction project, etc.

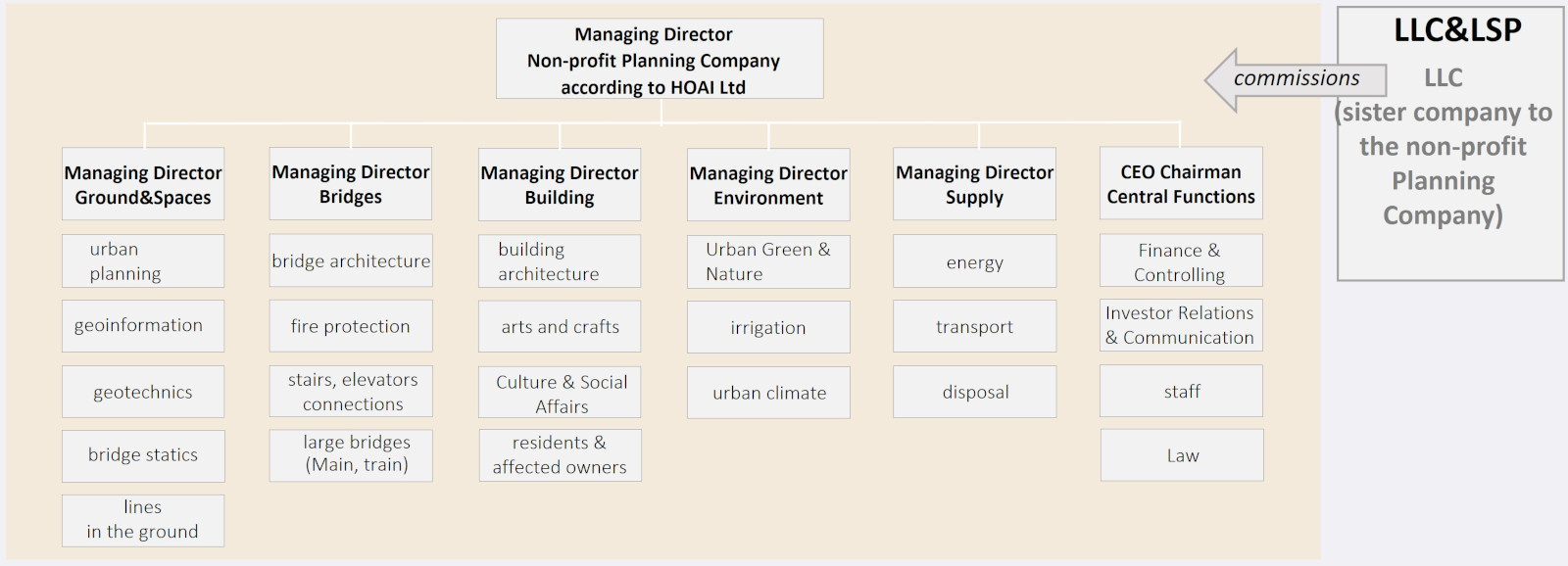

The Planning Company according to HOAI Ltd in the official planning phase, which replaces the Concept Planning company after the development and adoption of eight development plans, is many times larger with the same structure

With several hundred employees and a total budget of around 6 billion euros, this non-profit Ltd company provides such a detailed preliminary planning on behalf of the owners (i.e. the investors’ LLC&LSP) which is moreover so well coordinated with all stakeholders, that the 10-year construction phase, which follows after around 5 years of official planning, can be carried out quickly, efficiently and with extremely high quality while keeping costs within budget.