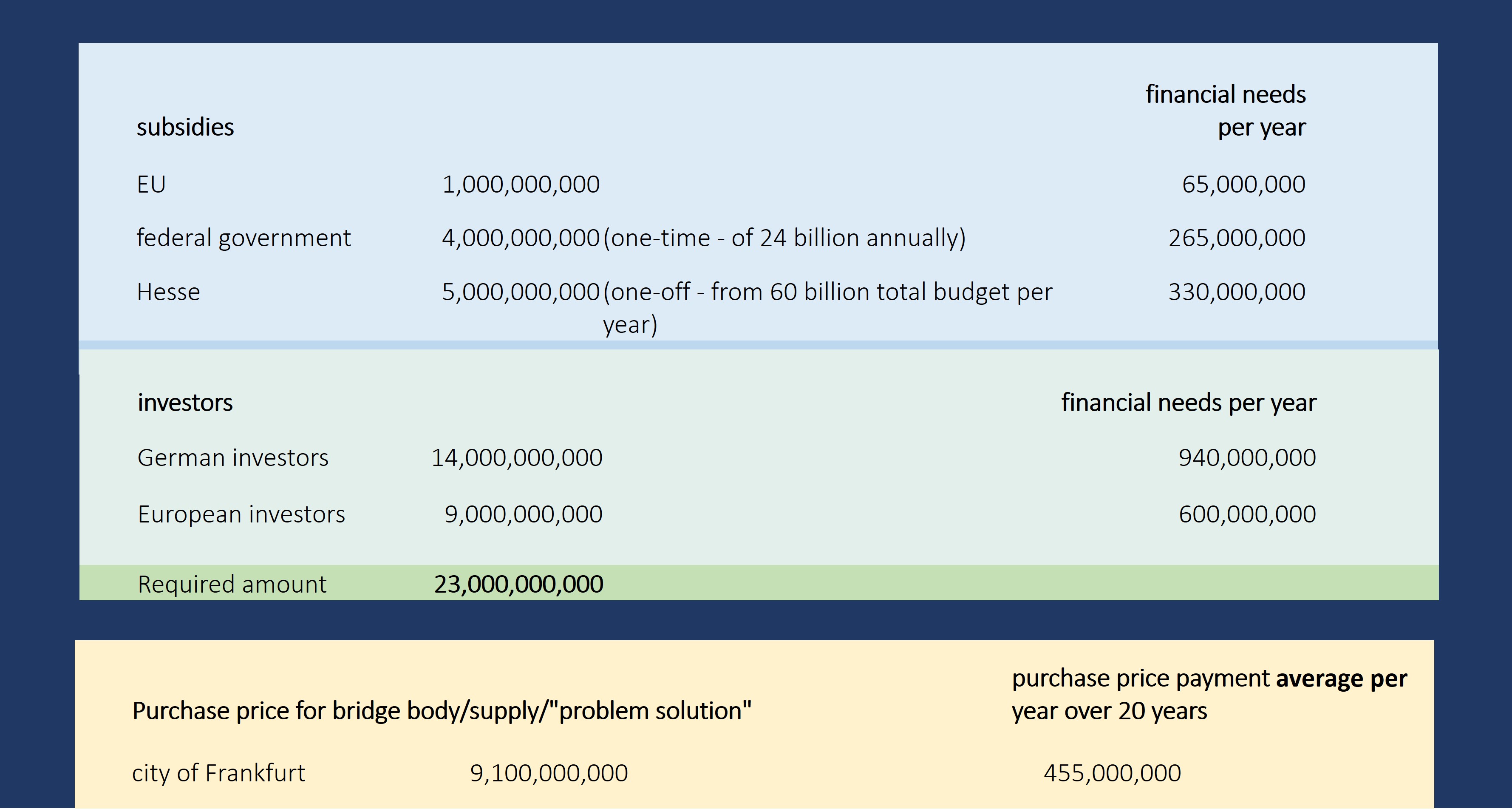

Potential investors for the Frankfurt bridges benefit from low risk through government subsidies, interest rates and, if applicable, tax breaks

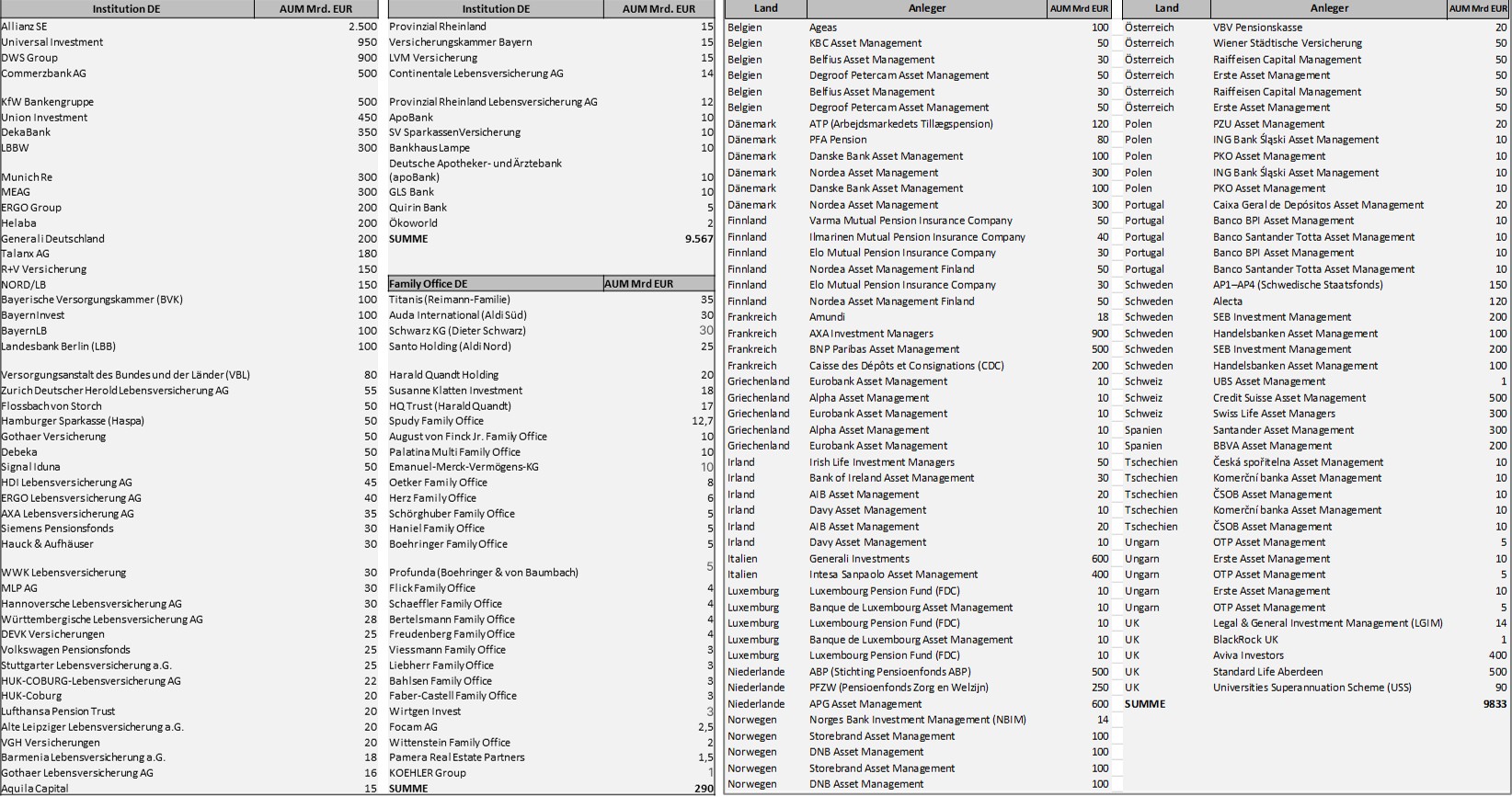

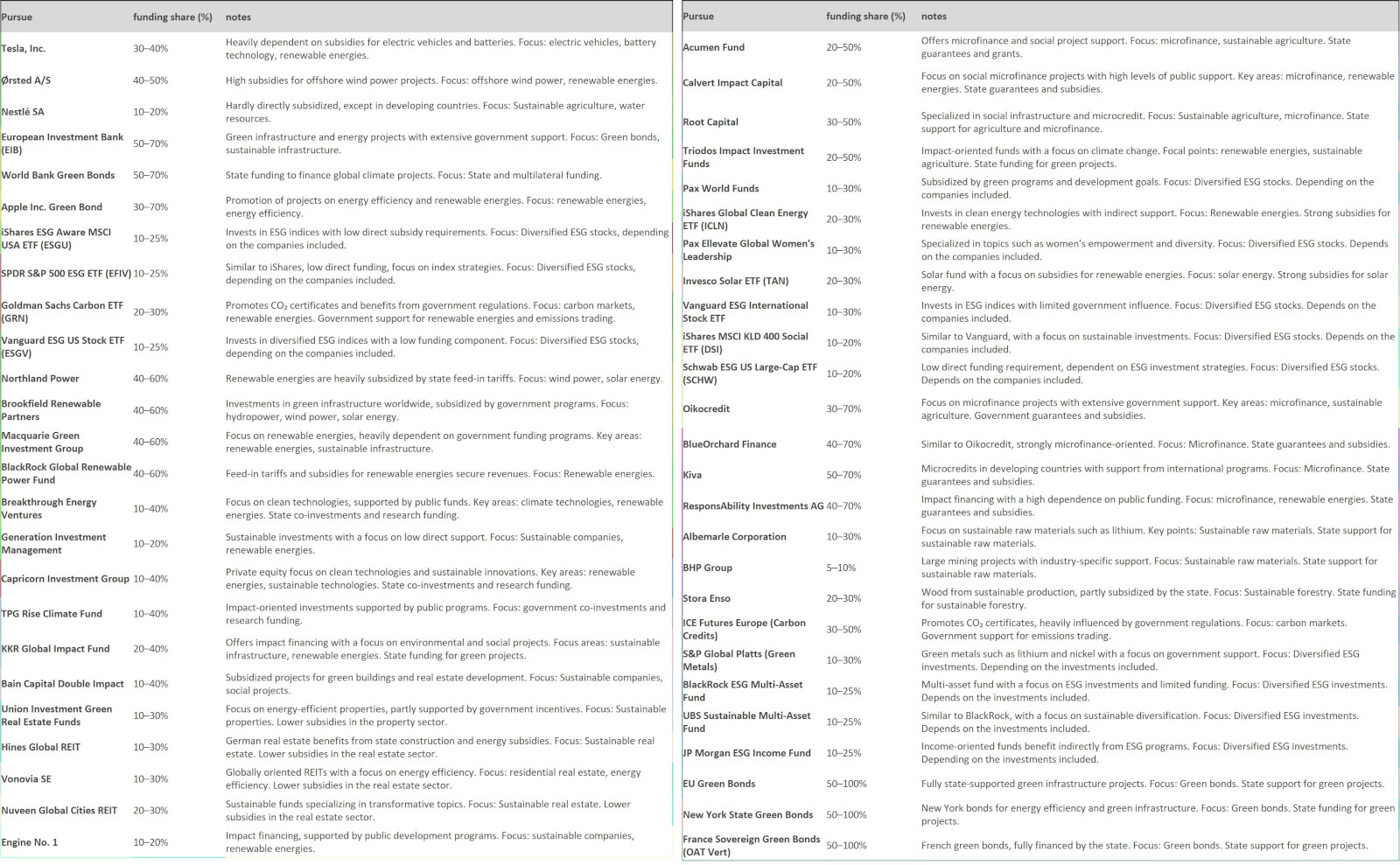

The total investment of 33 billion over 15 years represents a considerable sum per year: However, since the Frankfurt bridges represent a low-risk and prestigious investment for ESG funds, family offices and also industry, which can claim all ESG benefits such as public subsidies and funding, there are enough investors in Germany and Europe for whose portfolios the Frankfurt bridges represent an enrichment. Even if non-European participation should not be ruled out in principle, the focus can easily be on intra-European investors: After all, the Frankfurt bridges are intended to serve as Europe's Silicon Valley!

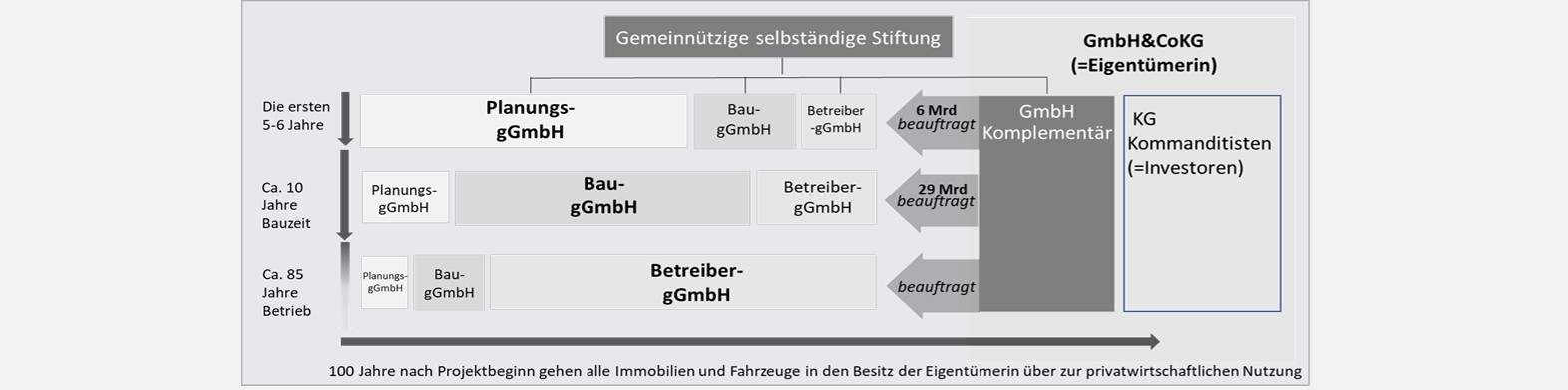

The chosen structure as a GmbH & Co. KG with a hybrid, listed fund approach allows for tax-optimized, long-term secured financing and sustainable use of the Frankfurt bridges. It combines the tax advantages of a REIT, the long-term investment security of an ELTIF and the regulatory advantages of an AIF to create an efficient and attractive capital structure for investors. Additions such as an independent advisory board, tranching system, market maker, ESG certification and long-term operating contracts further contribute to the efficiency and stability of the structure.

More than two-thirds of the total investment for the Frankfurt bridges is planned by private investors

Less than a third comes from grants, and the city of Frankfurt, which is the biggest beneficiary of the project, does not come into play through grants but only through purchasing the bridge infrastructure, which increases local political acceptance.

The Frankfurter Brücken are organized as a GmbH & Co. KG; this structure allows a clear separation between the investors as capital providers and the non-profit management.

The general partner is a GmbH that acts as a subsidiary of a non-profit independent foundation. This GmbH has the exclusive task of outsourcing the planning, construction and operation of the bridges to its sister companies (non-profit gGmbHs). The parent company of the acting general partner GmbH and its non-profit sister gGmbHs, the non-profit foundation, should be provided with an independent advisory board made up of representatives from the city of Frankfurt, the state of Hesse, the EU and independent experts. This strengthens the transparency and legitimacy of the project in the long term and sustainably.

Limited partners are exclusively private investors who contribute capital without operationally intervening in management. A tranching system could be introduced here, whereby investors can choose between different tranches depending on their risk appetite and investment horizon (e.g. low-risk tranches with fixed interest rates and higher-risk tranches with higher return potential). This could ensure that different types of investors can be addressed. Furthermore, a minimum participation should be set to avoid excessive fragmentation of shares .

The operational units are non-profit sister companies (gGmbHs) of the general partner GmbH, which take over the individual phases (planning, construction, operation). A clear catalogue of services and control mechanisms should be agreed between the sister companies (gGmbHs) and the general partner GmbH in order to ensure efficiency and quality.

The high subsidy share of the total investment must not lead to public interference in the implementation of the construction and operation of the Frankfurt bridges

The total investment for planning and construction of the Frankfurt bridges amounts to 33 billion euros, divided into 23 billion euros from private investors (limited partners of the GmbH & Co. KG) and 10 billion euros as public subsidies.

To ensure that the subsidies flow into the GmbH & Co. KG and not into the operating construction companies or service providers, the following processes are useful:

- Grant agreements are concluded with the State of Hesse, the Federal Government and the EU, which stipulate that the GmbH & Co. KG acts as the recipient of the funding.

- The funds are drawn down according to the progress of construction, so that the GmbH & Co. KG has full control over the allocation and use of funds.

- The release to the non-profit gGmbHs by their sister GmbH, the general partner, takes place according to the internal mechanisms of the GmbH & Co. KG, without interference from the public sector.

- The awarding of contracts to planning and construction companies is therefore completely organized by the non-profit sister companies, which clearly separates the operational management.

This solution ensures both the tax transparency and the economic independence of the project and prevents public authorities from interfering in the construction and management processes.

The Frankfurter Brücken Investment has a hybrid structure consisting of a project company and a regulated fund structure

The GmbH & Co. KG is designed as a project company that focuses exclusively on the financing, construction and operation of the Frankfurt bridges. It has the classic features of a long-term infrastructure project company, but combines the regulatory advantages of a fund structure.

With its project company character, it offers investors clear governance structures, long-term return stability and thus a transparent and plannable investment structure. Its project company character can be justified by the following points:

- The company is responsible for financing, constructing and operating the bridges – a clearly defined individual project.

- It is a long-term investment property with stable returns after completion.

- A separation of operation and financing is guaranteed: the general partner GmbH manages the projects, the KG finances them.

Capital is raised using a hybrid fund approach. This hybrid solution with regulated fund structures can be justified by the following features and is attractive to investors for the following reasons:

- Since the KG itself does not undertake any operational activities of its own, but merely collects capital and manages it, it can therefore be regulated as an alternative investment fund (AIF).

- The combination with REIT and ELTIF elements also ensures tax advantages and makes the structure attractive for institutional investors.

- The stock exchange listing of the KG shares makes them particularly liquid and flexibly tradable, making them suitable as an investment vehicle for long-term investors.

The KG itself is structured as a hybrid fund that combines elements of an alternative investment fund (AIF), a REIT (Real Estate Investment Trust) and an ELTIF (European Long-Term Investment Fund). The capital is raised once at the beginning and remains tied up for the long term. Accordingly, the KG's shares should be freely tradable, but without any obligation on the part of the fund to return them.

Capital is raised in tranches over a period of five to ten years in order to avoid interest costs for unused capital. However, the capital commitments must be sufficient to be considered secured. The actual payments are made by default on a drawdown schedule based on construction progress.

The KG itself, as a hybrid fund, has the following characteristics

Elements of the Alternative Investment Fund (AIF) at the Frankfurter Brücken Investment:

·Regulation is carried out in accordance with the Capital Investment Code (KAGB), which gives institutional investors access.

·It is a largely flexible capital structure for long-term investments in infrastructure.

·Tax transparency is established at fund level so that investors can benefit depending on their tax status: An independent trustee should be appointed to monitor compliance with AIF regulations and prepare regular reports to investors.

Elements of the REIT (Real Estate Investment Trust) in the Frankfurter Brücken Investment:

·The investment has a listed structure to ensure easy tradability of the shares.

·It has tax exemption or relief for current income from infrastructure.

·There is also an obligation to regularly distribute a large portion of the profits to investors.

·The company structure offers a high level of transparency and compliance to make it easier to obtain funding from public bodies.

·The listing should take place on a reputable stock exchange (e.g. Frankfurt, London) in order to appeal to international investors. A market maker should be used to ensure the liquidity of the shares and to avoid strong price fluctuations.

Elements of the ELTIF (European Long-Term Investment Fund) at the Frankfurter Brücken Investment:

·The investment offers long-term capital commitment with attractive tax advantages for investors.

·Frankfurter Brücken has a clear ESG focus to appeal to institutional and private investors with sustainable investment goals.

·The overall project is subject to a regulated structure that provides investment protection and market confidence throughout the EU.

·ESG standards should be introduced to demonstrate the sustainability of the project and to achieve additional tax benefits. However, ESG criteria should be implemented without official certification by ensuring them through separate ESG standards within the GmbH & Co. KG or through the statutes of the non-profit sister companies of the general partner GmbH. Official certification entails bureaucracy and ongoing audit obligations, which would cause additional costs and paralyze the entrepreneurial orientation in the construction and operation of the bridges, and should therefore be avoided.

The investment volume of private bridge fund investors of EUR 23 billion represents only 0.23% of the total AUM in Germany and only 0.12% in Europe

The investment in the Frankfurt bridges over a period of 15 years with a subsequent term of 85 years is therefore on a manageable scale.

The investment in the Frankfurt bridges over a period of 15 years with a subsequent term of 85 years is therefore on a manageable scale.

The Frankfurt bridges are a showcase for innovations and an ongoing research platform. This makes it interesting for a wide range of industries to invest in the planning and construction of the bridges:

•The concrete industry can use innovative concrete products (low cement, lightweight, enriched with composites, etc.) in isolated buildings and bridge sections without superstructures

•Technology companies can build a complex intelligent transport system for the first time

•Car manufacturers and manufacturers of sensors or technology integrators can use the bridge vehicles to produce a diverse fleet of autonomous models. The car manufacturers can develop modular vehicles whose bodies are extremely high-quality and durable, and whose "inner workings" can be replaced depending on technological advances.

•Energy and IT companies can develop the complex control of decentralized energy generation units from different sources (PV, geothermal energy, solar heat, waste heat from data centers) for a huge district

•The same applies to the intelligent control of rainwater management and the “water-sensitive city”.

Etc. etc. to name just a few examples.

A comparable motivation to participate in investments in the future of research is very prominent in the automotive industry: IONITY, the European high-power charging network, announced an investment of 700 million euros in November 2021 to accelerate the expansion of its fast-charging network for electric vehicles.

The companies involved are the BMW Group, Daimler AG (Mercedes-Benz), the Ford Motor Company and the Volkswagen Group with Audi and Porsche.

These funds come from both the existing shareholders – including BMW Group, Ford Motor Company, Hyundai Motor Group, Mercedes-Benz AG and the Volkswagen Group with Audi and Porsche – and from BlackRock, which has joined as a new partner. Similar constellations can be designed for the Frankfurt bridges.

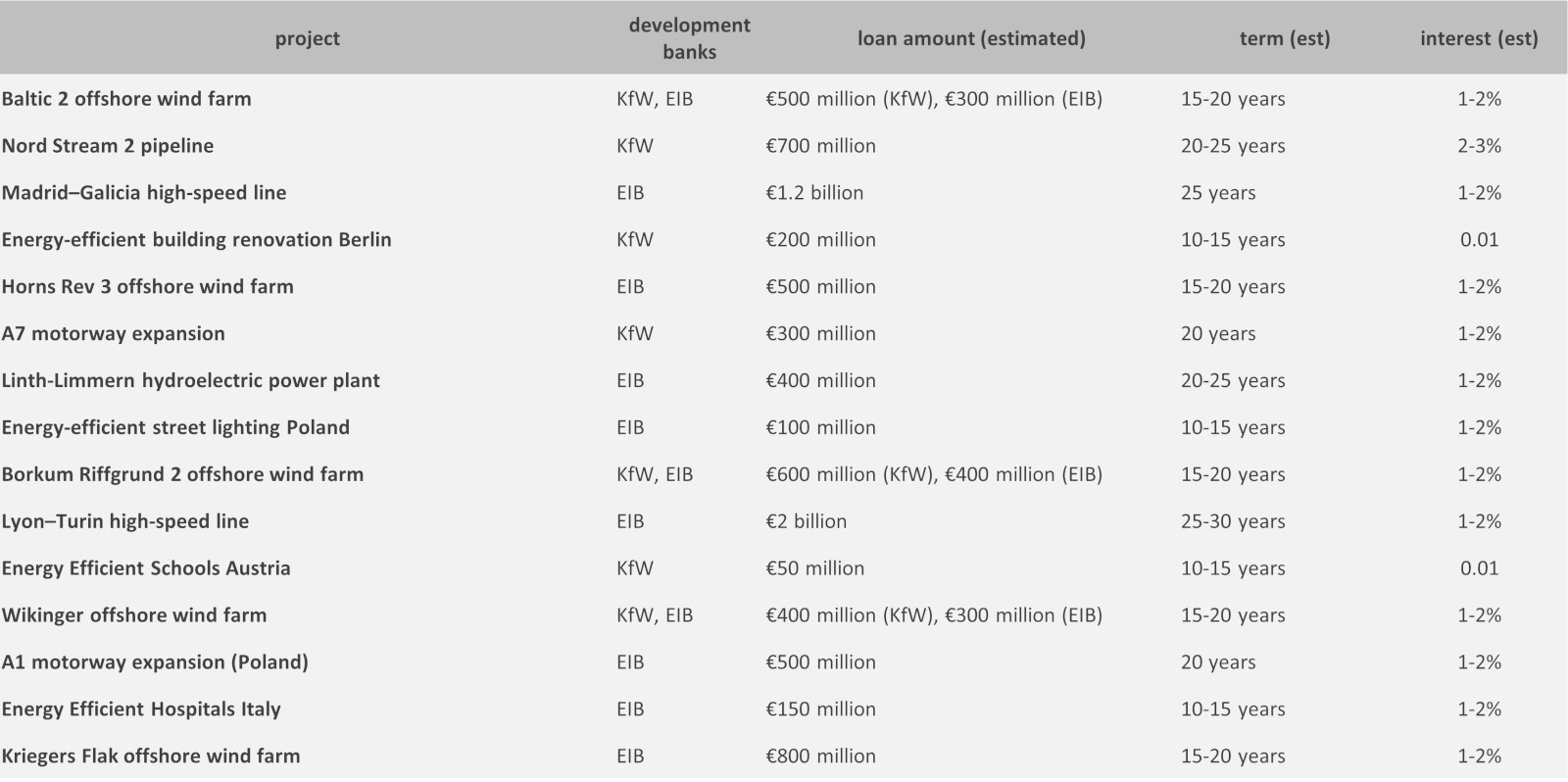

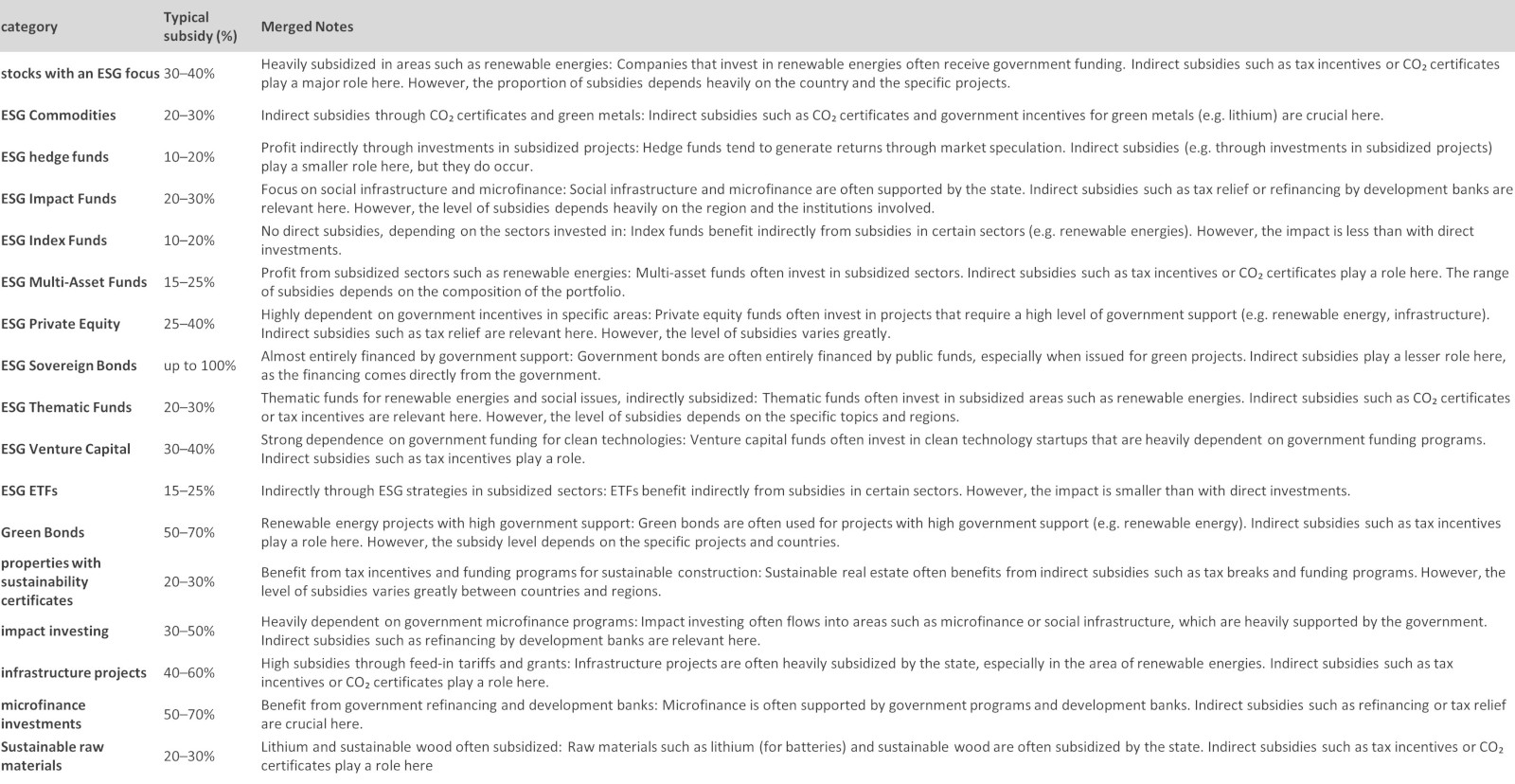

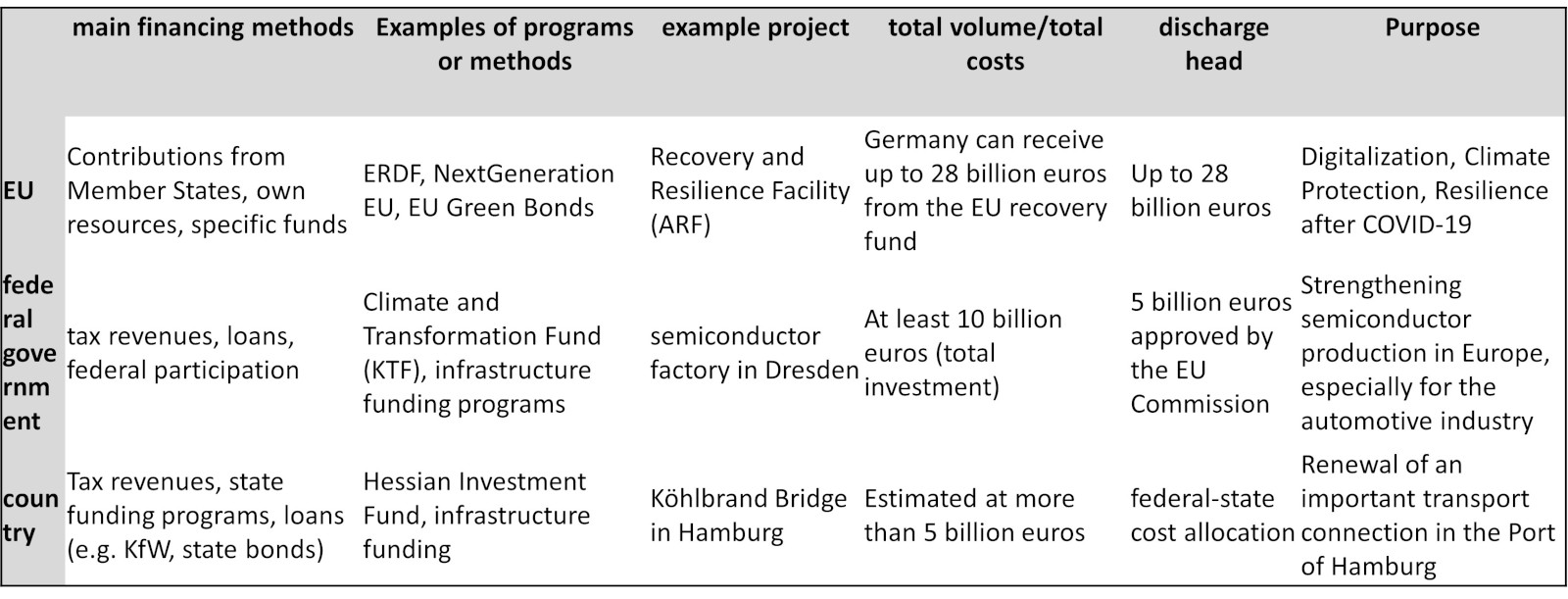

The 10 billion in subsidies planned by the state, federal government and the EU also represent 30% of the total investment amount – which is also not an unusual amount for ESG investments

There are several examples worth billions that have a similarly high funding share as the Frankfurt bridges – although the total volume is not quite as large as the bridge investment

However, it should be noted that the Frankfurt bridges do not serve a single purpose (e.g. a single transport connection, a single energy park or a single train station), but rather an entire district that can positively change the lives of hundreds of thousands of people - in Frankfurt itself and (as a kind of "blueprint"), by serving as a role model, the lives of millions of other people in cities around the world who are also building their city bridges with comparable technology.

The funding share for some ESG companies is up to 70%

The non-profit nature of the construction of the Frankfurt bridges for 100 years also justifies financing the investment with the help of development banks and low-interest loans – making the investment even more attractive for investors