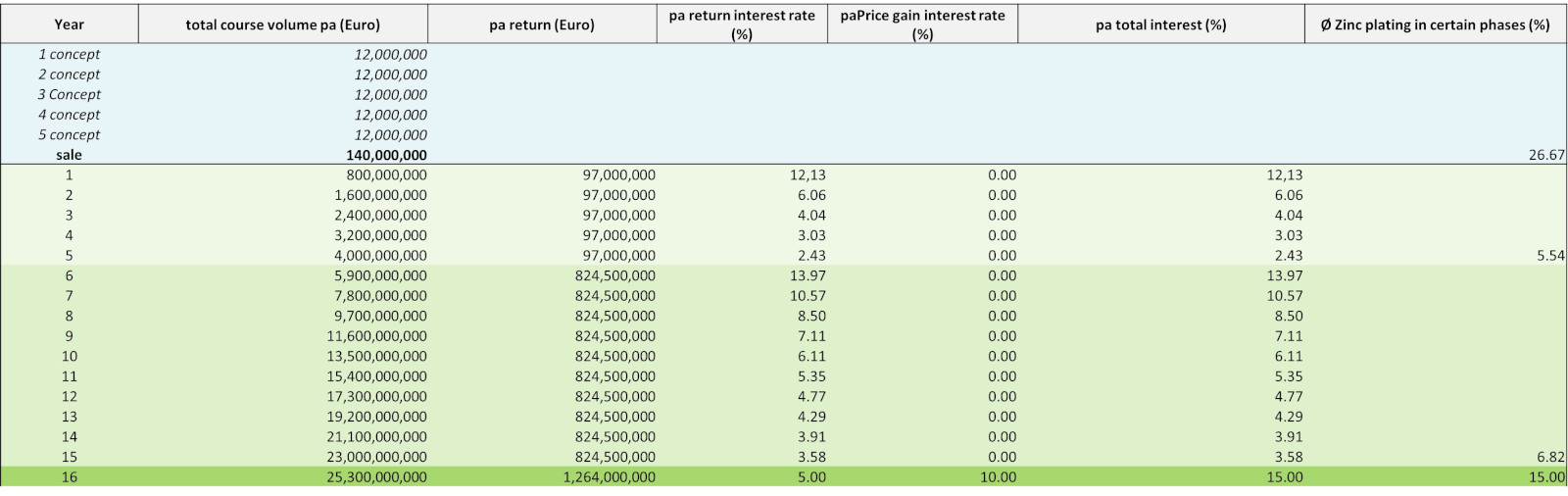

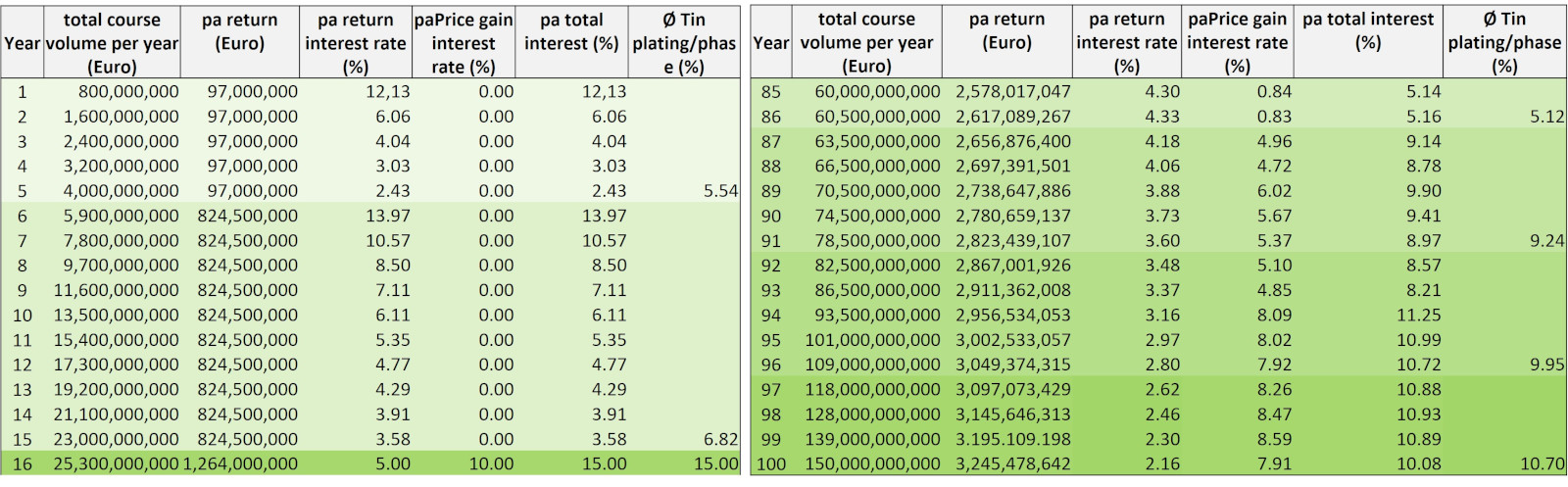

The investment in the Frankfurt bridges represents a decent interest-bearing investment – however, due to the extremely long term, tax reductions should be applied to current interest payments (dividends) and capital gains

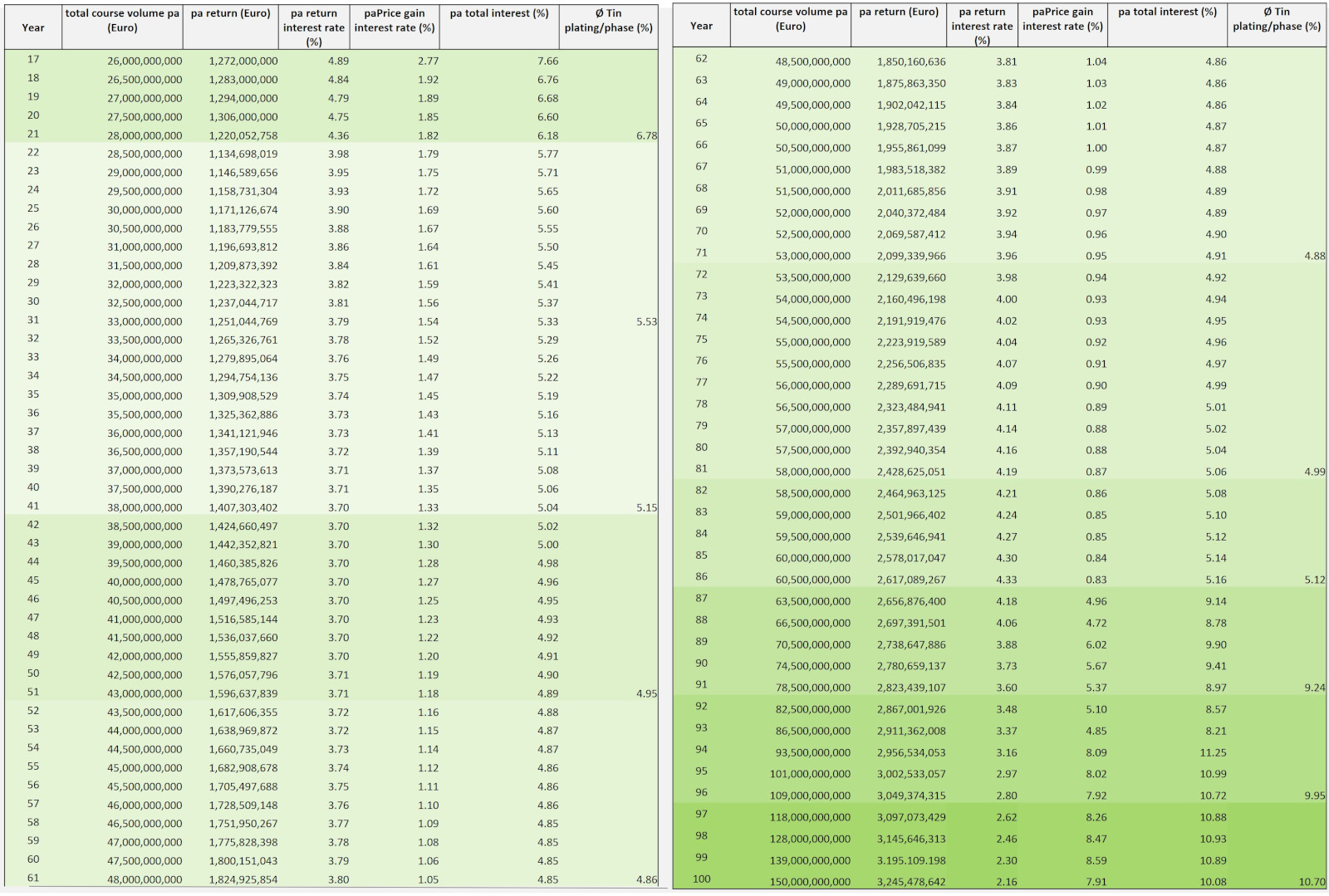

As an investment, the Frankfurt bridges are roughly equivalent in terms of their duration and profitability to an investment in a large port : During their construction, they generate an interest rate of around 5%-6% pa through progress-related purchase price payments from the city of Frankfurt for the bridge body, and can be sold by the initial investors in the year after completion with a further 10% profit, in order to then generate a low-risk return of around 5% pa over 65 - 70 years. It is only in the last two decades that the bridge investment has achieved an annual return of 10%, as the time is getting closer when the non-profit commitment no longer applies and the entire "luxury surface" of the Frankfurt bridges can be used or sold for profit.

In order to ensure the fungibility of the bridge fund shares over the entire 100-year term and to make them particularly attractive, an exemption from the taxation of dividends and capital gains should apply.

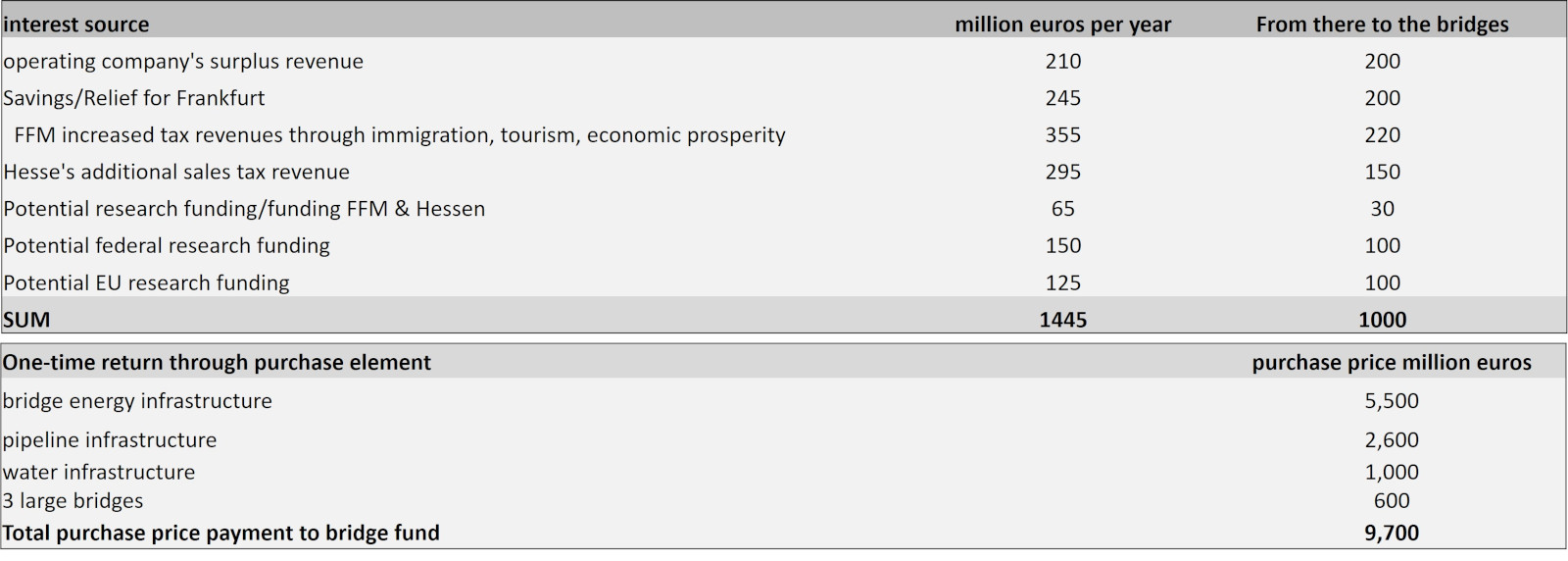

The interest on the capital of 23 billion euros contributed by the bridge fund is derived from the annual income of the operating company, subsidies from the city, state, federal government and EU, as well as the one-time sale of the bridge body after completion

Derwirtschaftliche Boom nach dem Bau derFrankfurterBrucken wirkt sich nicht nur auf die Stadt und das Rhein-Main-Gebiet

sondern aufHessen bzw.0berdie Forschung und Innovation auch auf ganz Deutschland und Europa aus.Die Efektesind hier

konservativ abgeschatzt worden und durften noch viel hoherliegen.Von dem beziffeten ,Gewinn" aufallen Ebenen werden rund

zveidrittel angesetzt,die in Formvon Fordergeldern regeImaBig an den BruckenfondszuruckflieBen und einen Bestandteilseiner

Verzinsung darstellen.

In den ersten beiden Dekaden kommt noch die gestaffeltezahlungdes Kaufpreisesfurdie Bruckeninfrastruktursovie die drei

GroBbrucken hinzu,andie StadtFrankfurt fur9,7Mrd Euroverkauftverden

The resulting returns are attractively related to the respective risk structure, depending on the phase of the project

The phase that is by far the riskiest and most profitable - but at 60 million it is also the smallest part of the investment - is the concept planning phase: here the concept of the Frankfurt bridges must be developed so well and in such detail that the development plans are actually approved. However, investors in this phase have the advantage that, based on the feasibility study by the Altes Neuland Frankfurt Foundation, they can identify the most important risk factor, political approval, in advance before the concept planning phase begins, making the risk easier to assess .

The planning phase according to HOAI carries a significantly lower risk if acceptance by politicians (including offices and authorities) and the population has already been ensured in the preceding phase. Nevertheless, a high return on investment can be expected here (partly secured by initial purchase price payments from the city of Frankfurt), because the incentive to invest should be as high as possible at the start of the project.

As soon as the construction phase begins, with such intensive, excellent pre-planning and complete backing from politicians and the public as well as a non-governmental project management, the only risk that remains is that during construction, geological or static conditions could turn out to be different from what the expert reports had predicted. This is taken into account in the return forecast at around 5 to 6 percent. After construction, regular and largely risk-free operation takes place.

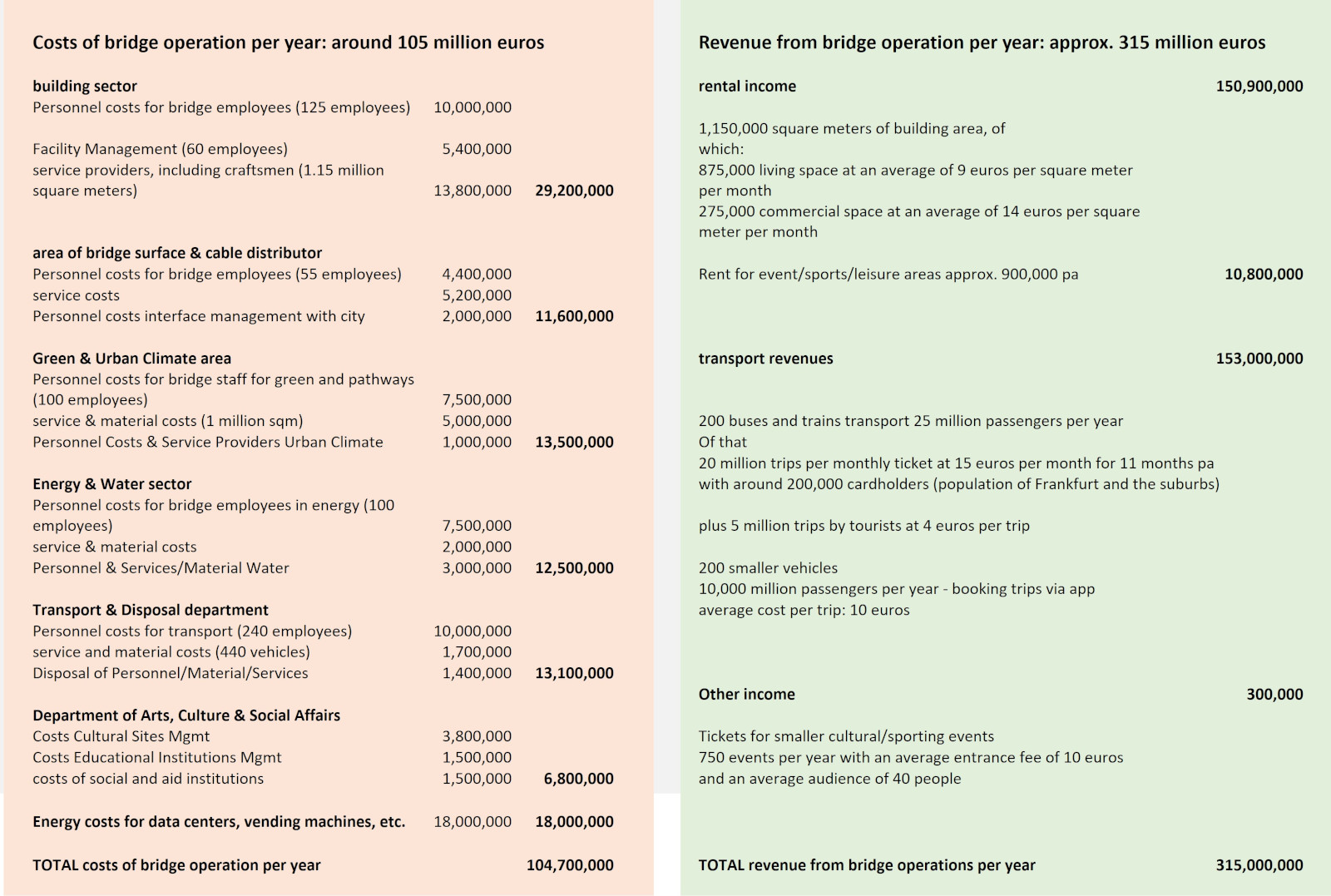

(1) Interest on surpluses from the bridge operation: around 210 million euros per year

(1) The operating company receives 150 million euros in rental income annually from the Frankfurt bridges

The figures are also based on the price levels of 2023/2024. According to the German pension insurance, the average pension during this period was around 1,100 euros per month net (ie the old-age pension actually paid out: it reflects the average net pensions and takes into account factors such as actual contribution periods and deductions for health and long-term care insurance). In many apprenticeships, the monthly income is also less than 1,000 euros per month. Accordingly, part of the living space must even be valued at less than 9.50 euros per square meter in order to ultimately arrive at this average price per square meter. However, it can be assumed that over the course of the first 25 years of the bridge operation, the level of prosperity in Frankfurt will grow so much that the price per square meter can then be set higher (even for comparatively affordable living space).

The same applies to the commercial space on the Frankfurter Brücken, which only represents a very small proportion of office space and is mainly used for shops, restaurants, medical practices, small businesses, art, advice and assistance centers, educational and care facilities, etc. The price per square meter for areas of this type close to the city center is usually 20 - 24 euros per square meter. On the Frankfurter Brücken, however, only 15.50 per square meter is charged from the businesses, as they must meet requirements for employee training, use of the packaging disposal system, ecologically valuable product offerings, and the like.

Das gleiche gilt für die Gewerbeflächen auf den Frankfurter Brücken, die nur zu einem sehr geringen Teil Bürofläche darstellen, und hauptsächlich für Geschäfte, Gastronomie, Praxen, Kleingewerbe, Kunst, Beratungs- und Hilfsstellen, Bildungs- und Betreuungseinrichtungen u.ä. genutzt werden. Für gewöhnlich liegt der Quadratmeterpreis für innenstadtnahe Flächen dieser Nutzung bei 20 – 24 Euro/Quadratmeter. Auf den Frankfurter Brücken werden jedoch lediglich 15,50 pro Quadratmeter von den Gewerbetreibenden verlangt, da sie Auflagen zur Weiterbildung der Mitarbeiter, Nutzung des Verpackungsentsorgungssystem, ökologisch wertvolle Produktangebote und ähnliches erfüllen müssen.

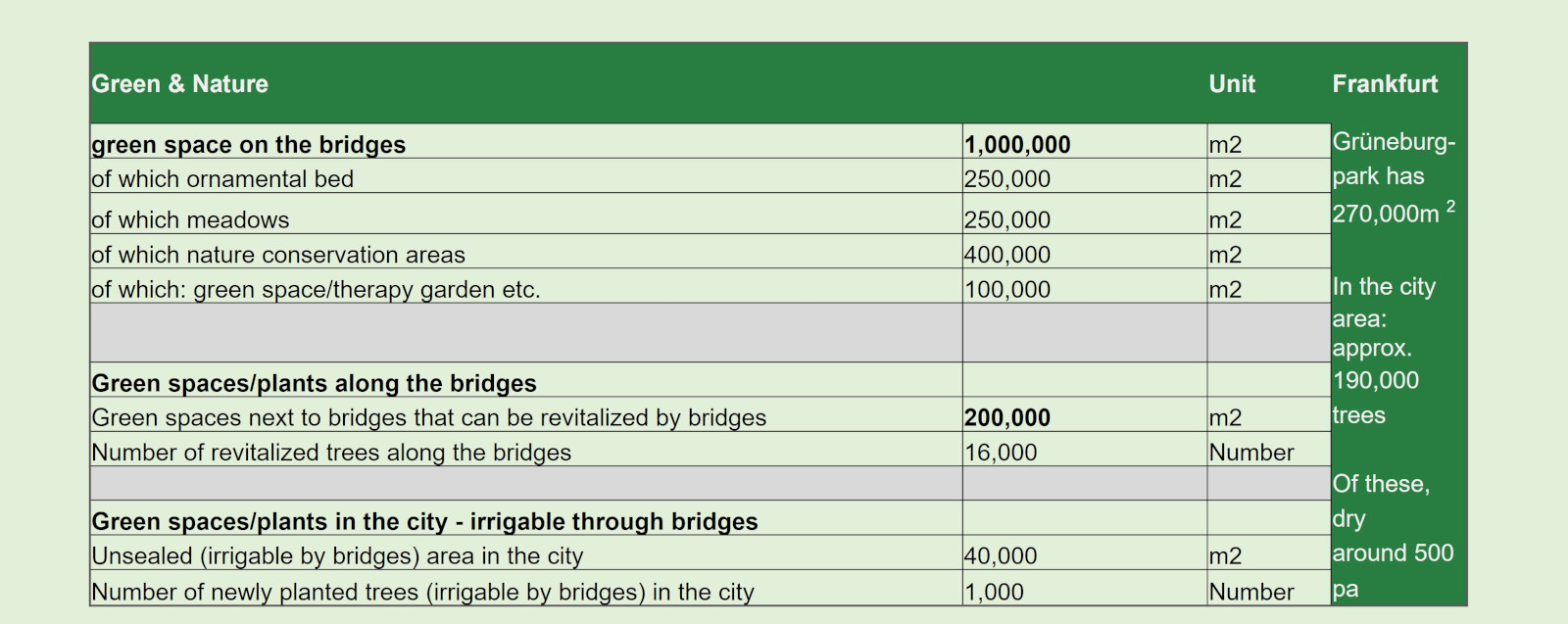

(1) The Frankfurt bridges have a green area of 1,000,000 square metres, of which around 50,000 square metres are rentable space, from which they collect around 10 million euros per year in usage fees

On the Frankfurt bridges, most of the green areas are accessible free of charge, such as therapy gardens, lawns, farm gardens, etc. However, there are also sports fields, urban gardening areas, yoga meadows, etc., which are available to operators or individual users at the extremely low price of 60 cents per square meter per day.

This is also justified by the fact that the Frankfurt bridges are intended to offer a high social benefit to Frankfurt citizens. A 100 square meter yoga lawn can, for example, be rented for 2 hours for 10 euros, assuming that the 2 hours represent a sixth of the 12 hours in a day.

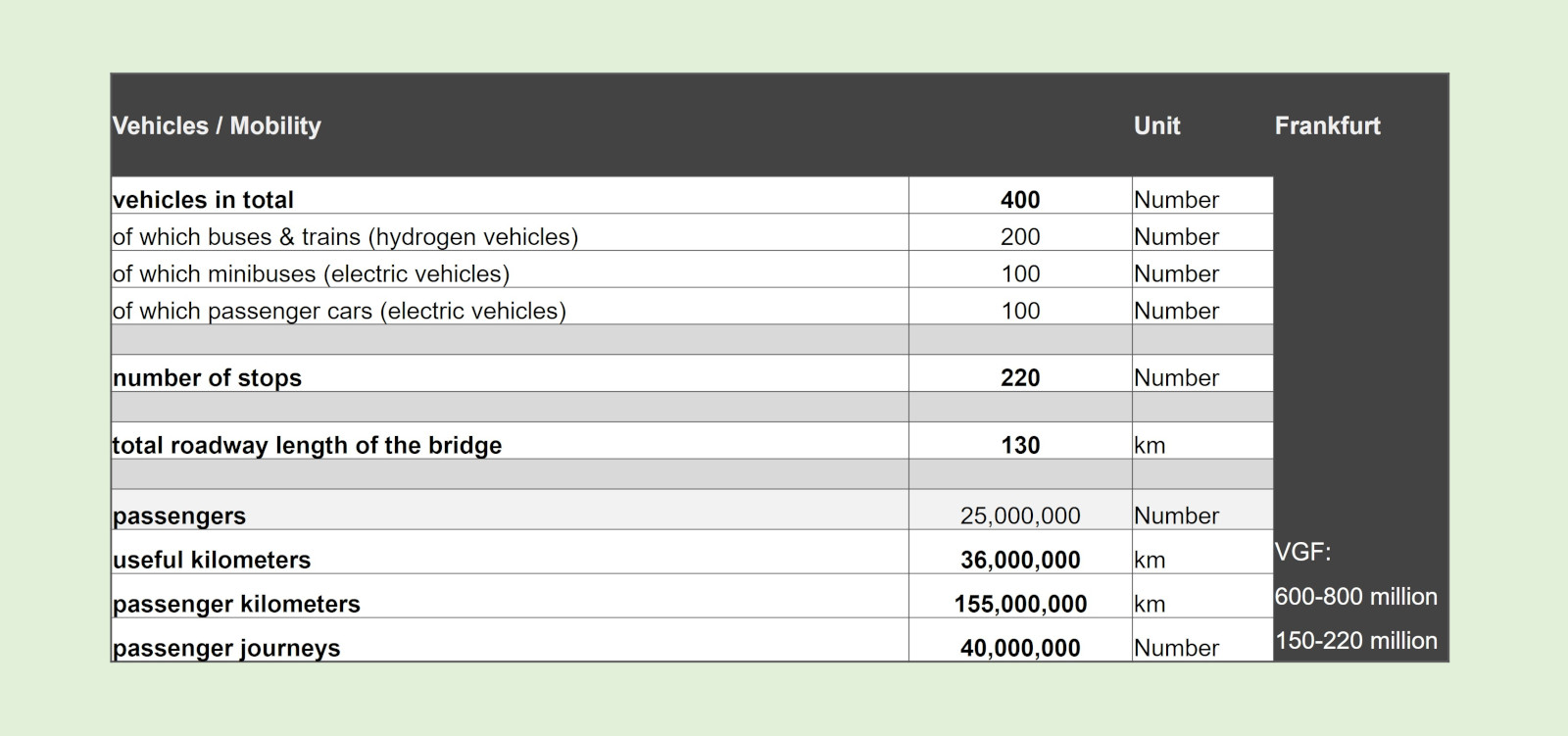

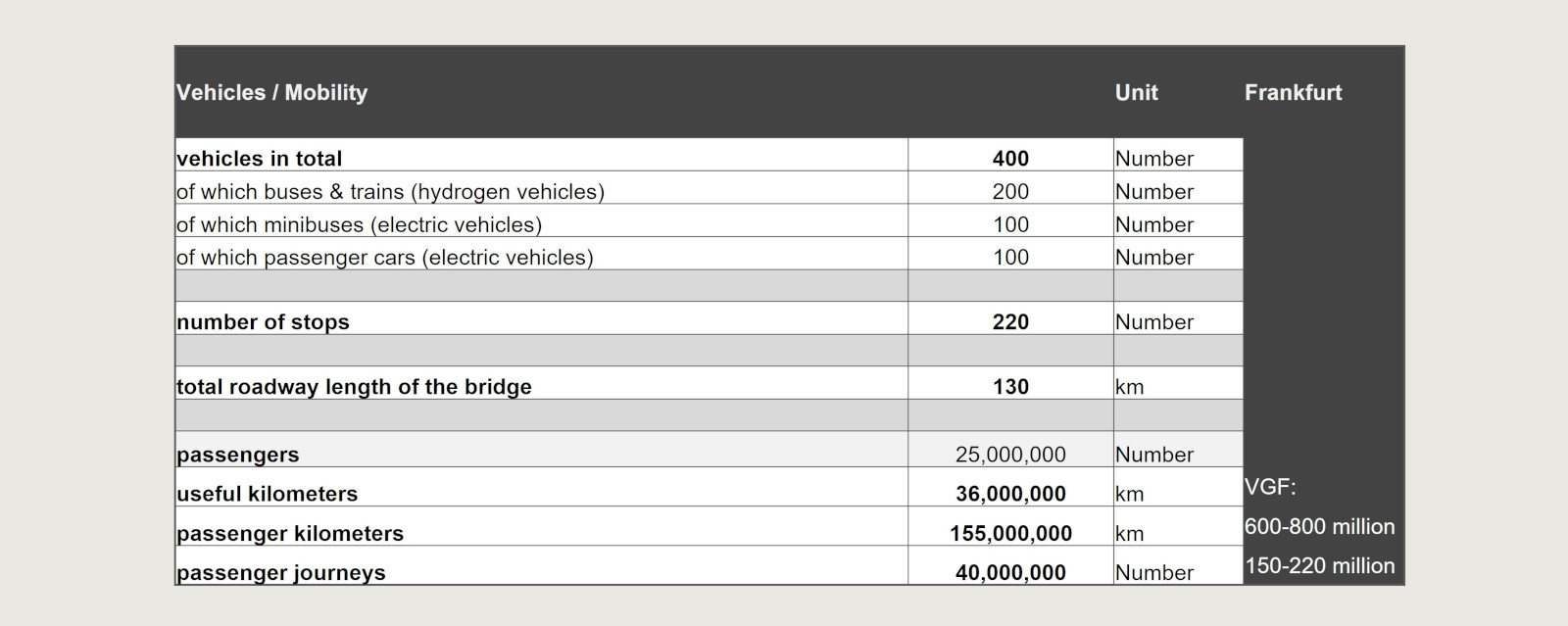

(1) The autonomous system on Frankfurt's bridges transports an estimated 35 million passengers per year and generates revenues of over 150 million euros

Frankfurt residents and residents of the immediate surrounding area can purchase monthly passes for 15 euros per month: assuming that around 200,000 cardholders take up this offer, the operating company will earn 3 million euros per month, and if the card is purchased for just 11 months, it will earn 33 million euros per year. 5 million passengers are likely to be tourists, who pay 4 euros per trip, which will earn 20 million euros. The most profitable are the 200 cars that can be called via an app and contribute 100 million to the revenue from bridge traffic with around 10 million trips and an average of 10 euros per trip (like a taxi).a

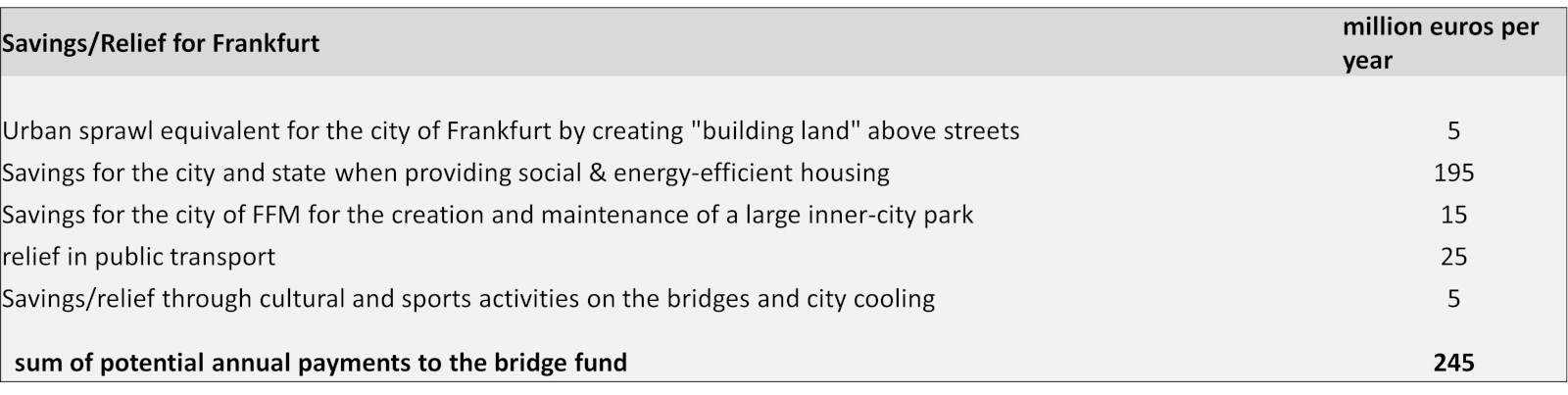

(2) Interest from annual added value for Frankfurt through savings for the city

Once the Frankfurt bridges are completed, the city of Frankfurt's budget will be significantly relieved, while the quality of life and living will increase significantly.

Some effects, such as the positive impact of the bridges on the urban climate (by creating unsealed green areas over dark sealed motorways) are difficult to quantify and have therefore only been estimated at a small amount of 2 million euros per year.

It is equally difficult to quantify the fact that the city of Frankfurt suddenly owns 2,000,000 square meters more land, on which many things are being built that the city would otherwise have had to sacrifice or provide land for - which is particularly disadvantageous when previously natural areas within the city are being developed, for example. Instead of assuming billions in land values for this, only a small amount per year has been assumed for the term of 85 years.

Other areas such as easing the burden on public transport or the creation of cultural and sporting facilities (two swimming pools, four stages, etc.) or a park, including the savings on sidewalk/lighting maintenance, are easier to quantify, as are the savings for the city in terms of the provision of social or energy-efficient housing.

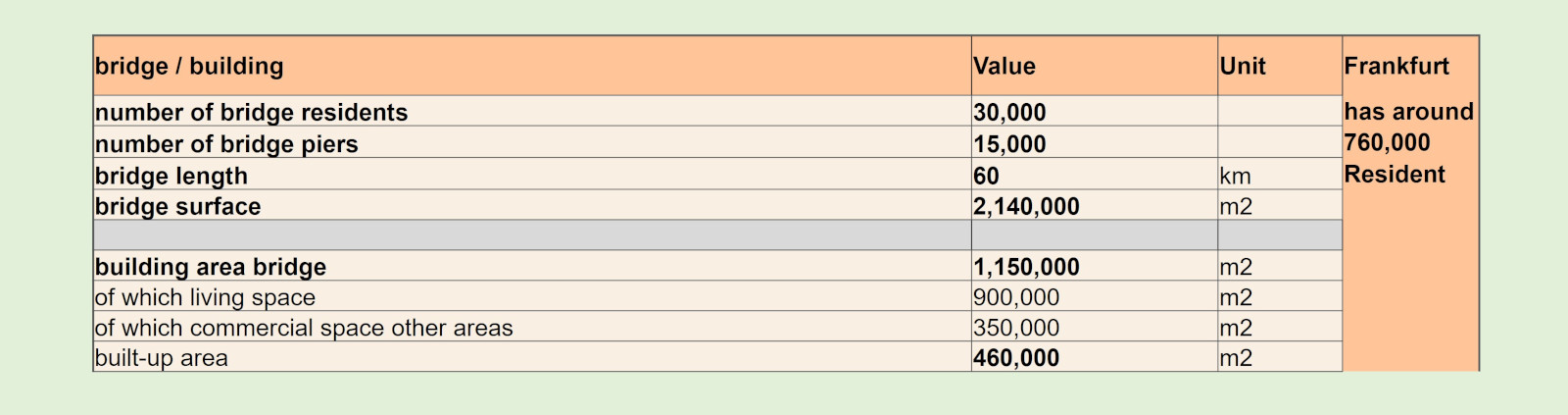

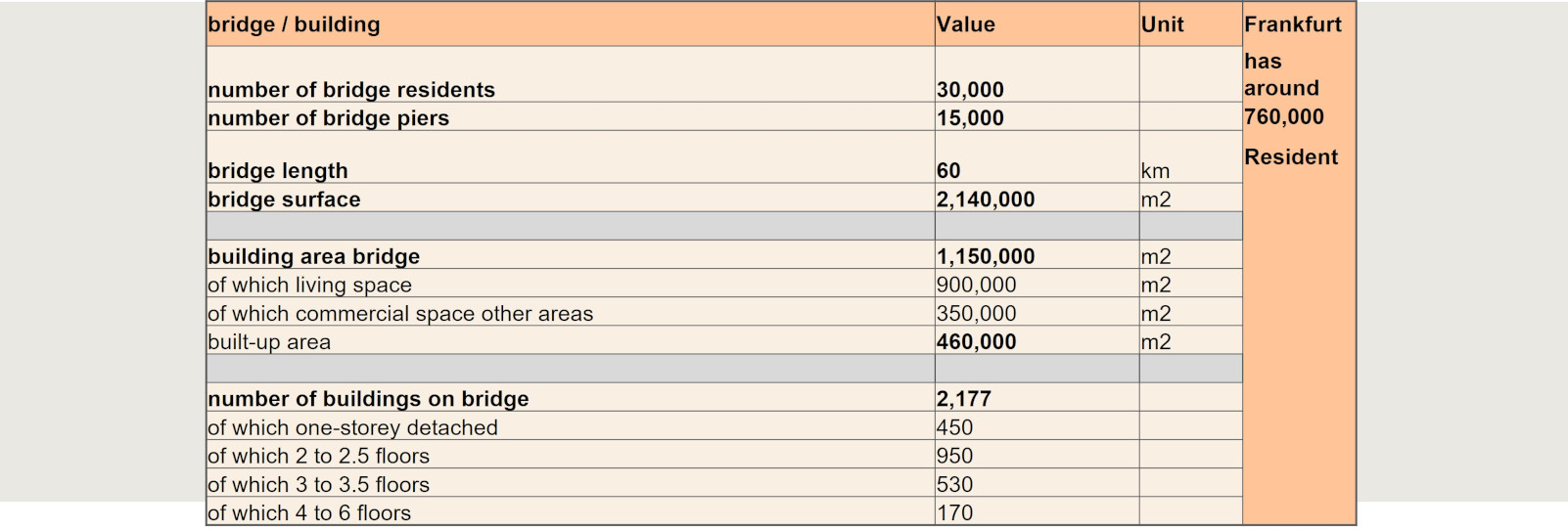

(2) The “sprawl equivalent” of the Frankfurt bridges can be estimated at at least 425 million euros along the designated building land potential of the city of Frankfurt

The city of Frankfurt benefits continuously from the fact that around 17,500 apartments are made available on the Frankfurt bridges for 30,000 people, which are affordable and energy efficient. On the one hand, this can be put into relation to the social and other subsidized housing in Frankfurt (see below). On the other hand, it is also important to take into account that the fact that more than 2,000 buildings are being built on the bridges over sealed, heavily trafficked and otherwise unusable areas prevents urban sprawl on Frankfurt's land. According to the current publications of the city of Frankfurt (as of 2023), the total building land potential of the urban area amounts to several hundred hectares, of which an estimated 300 hectares (3,000,000 sqm) are not yet very well developed. At least 500,000 sqm of this is not part of the building land potential and can be left natural or renaturalized . The added value for the city is difficult to estimate, but the “building land costs” for 500,000 square meters in Frankfurt alone. Even if one assumes a land value of just 850 euros per square meter for this area, the Frankfurt bridges save an urban sprawl equivalent of 425 million euros, or 5 million euros per year spread over 85 years.

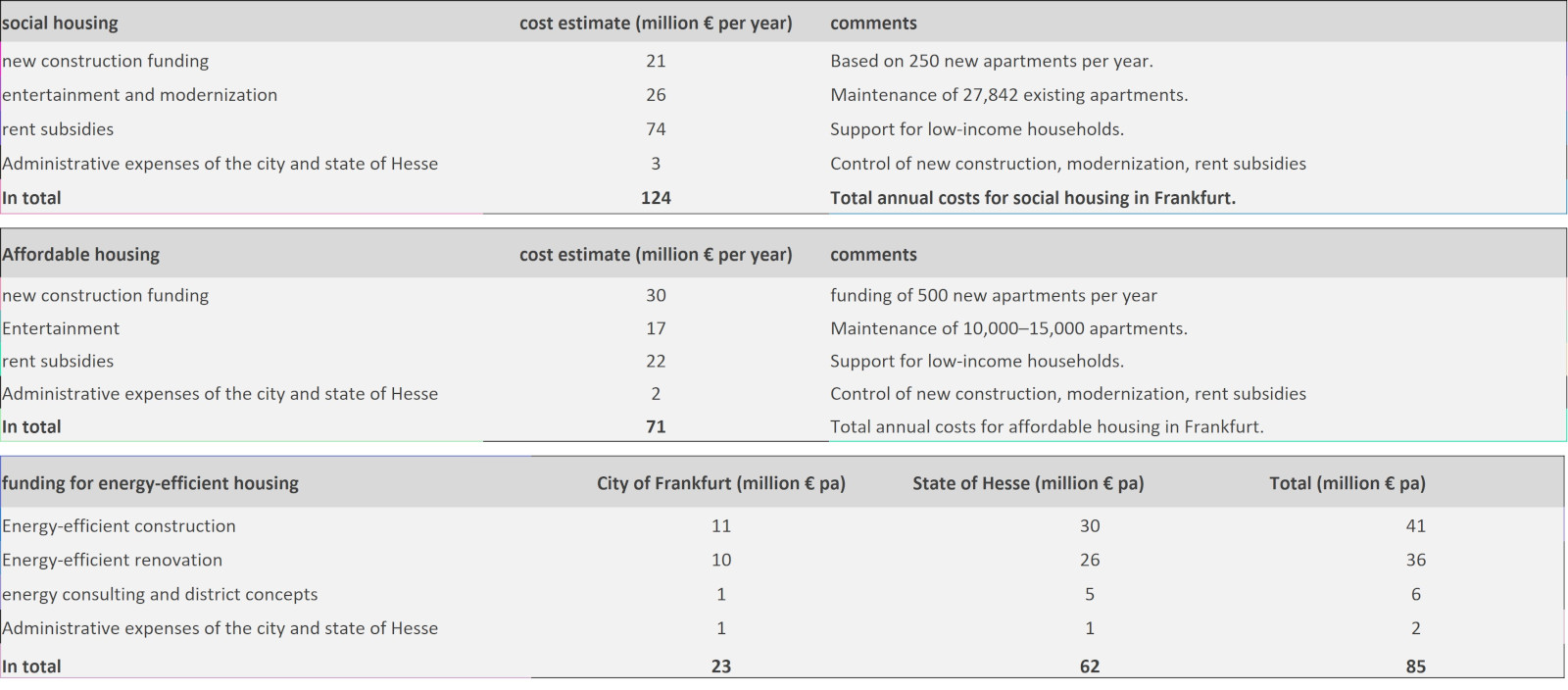

(2) The value of the buildings with affordable housing on the Frankfurt bridges for the city of Frankfurt amounts to around 195 million per year for 25 years

Around 17,500 apartments with affordable housing are being built on the Frankfurt bridges: At around 9 euros per square meter, this is housing for people with low to medium incomes. In addition, this housing is not only affordable, but also built in an energy-efficient manner. This means that the city of Frankfurt and the state of Hesse will not have to pay around 195 euros for around 25 years. Mio pa for the promotion of appropriate housing in these categories. The amount would indeed fall after 25 years by the amount of the new construction subsidy of around 50 million euros pa to 145 million euros per year: But since the level of prosperity increases during these 25 years for all citizens in Frankfurt - including low earners - an increased price per square meter can be set after 25 years, which compensates for the loss of new construction substitution that the bridges offer until then.

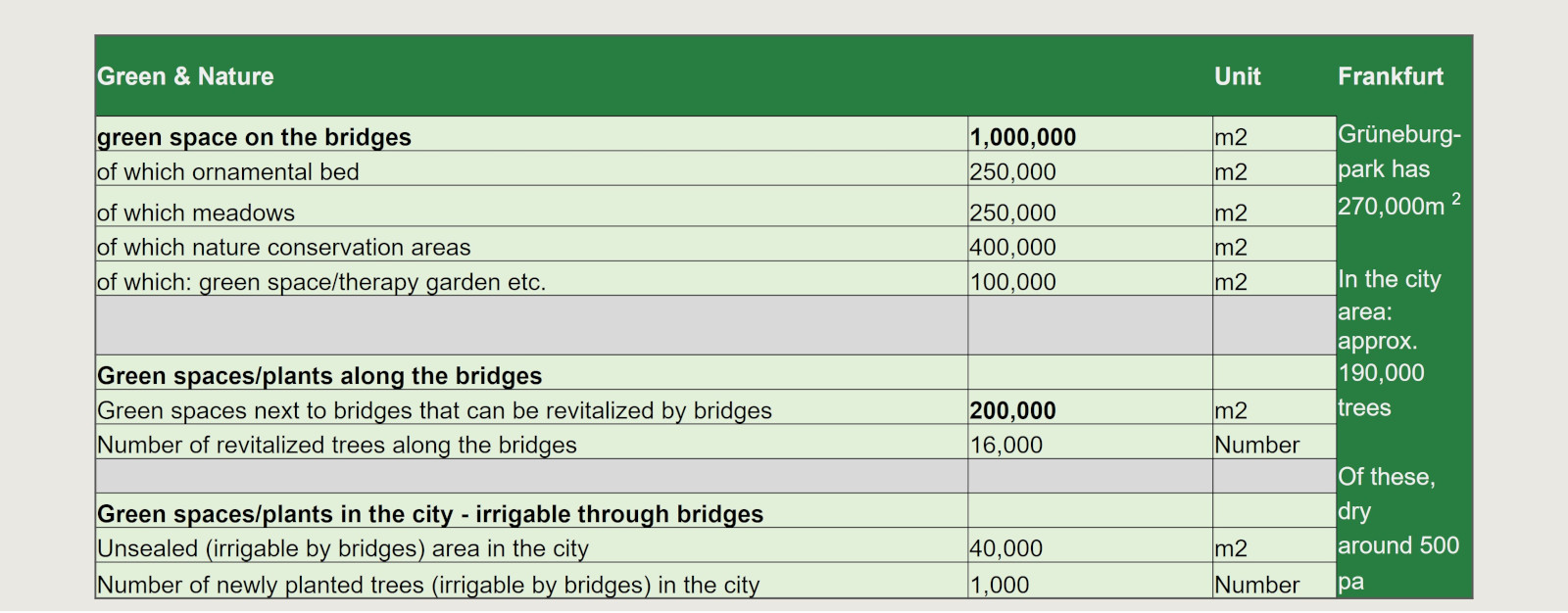

(2) A green area of 1,000,000 square meters will be created on the bridges, which is three times the size of Grüneburgpark or four times the area of the Palmengarten and has a value for the city of at least €255 million in land costs

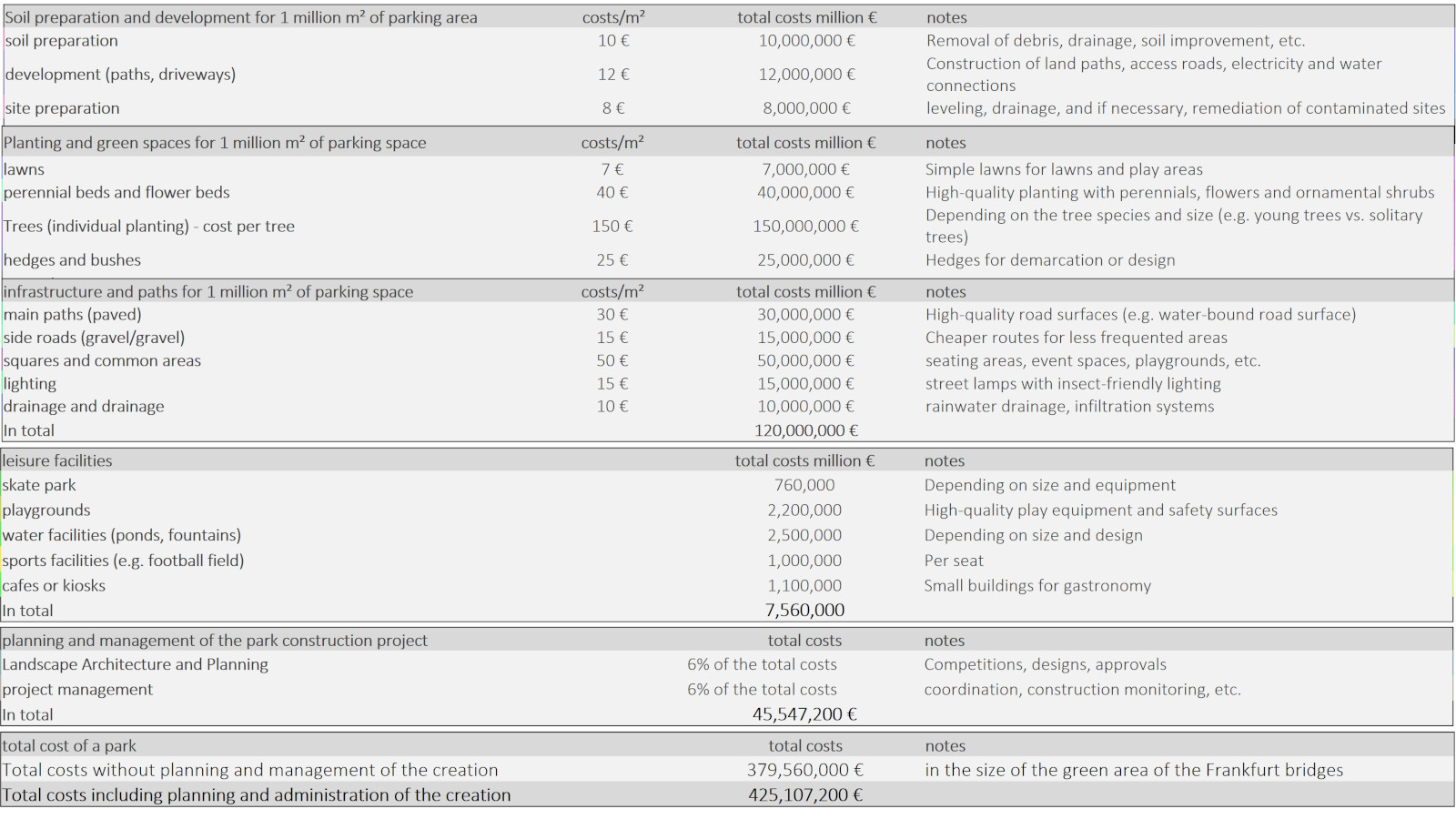

On the Frankfurt bridges, an easily accessible natural world with high leisure and recreational value is created for all of the city's citizens. On the one hand, this can be compared to the effort that Frankfurt would have to make to create such an area (see below - comparable to the creation of the Hafenpark in Frankfurt: around 8 million euros gross for around 40,000 square meters, ie costs of around 200 euros/m² with a significantly lower value compared to the Frankfurt bridges green spaces). On the other hand, the saving value of land for the city must be estimated, which, based on a parking area of just 255 euros per square meter, results in a value of 255 million euros - spread over an 85-year period of use (entirely for the purpose of the common good), this corresponds to a value of 3 million euros per year.

(2) The equivalent value of the 1 million square meters of green space on the Frankfurt bridges amounts to 485 million euros in one-off costs for the construction of a comparable park: spread over 85 years, this means an equivalent value of 5 million euro

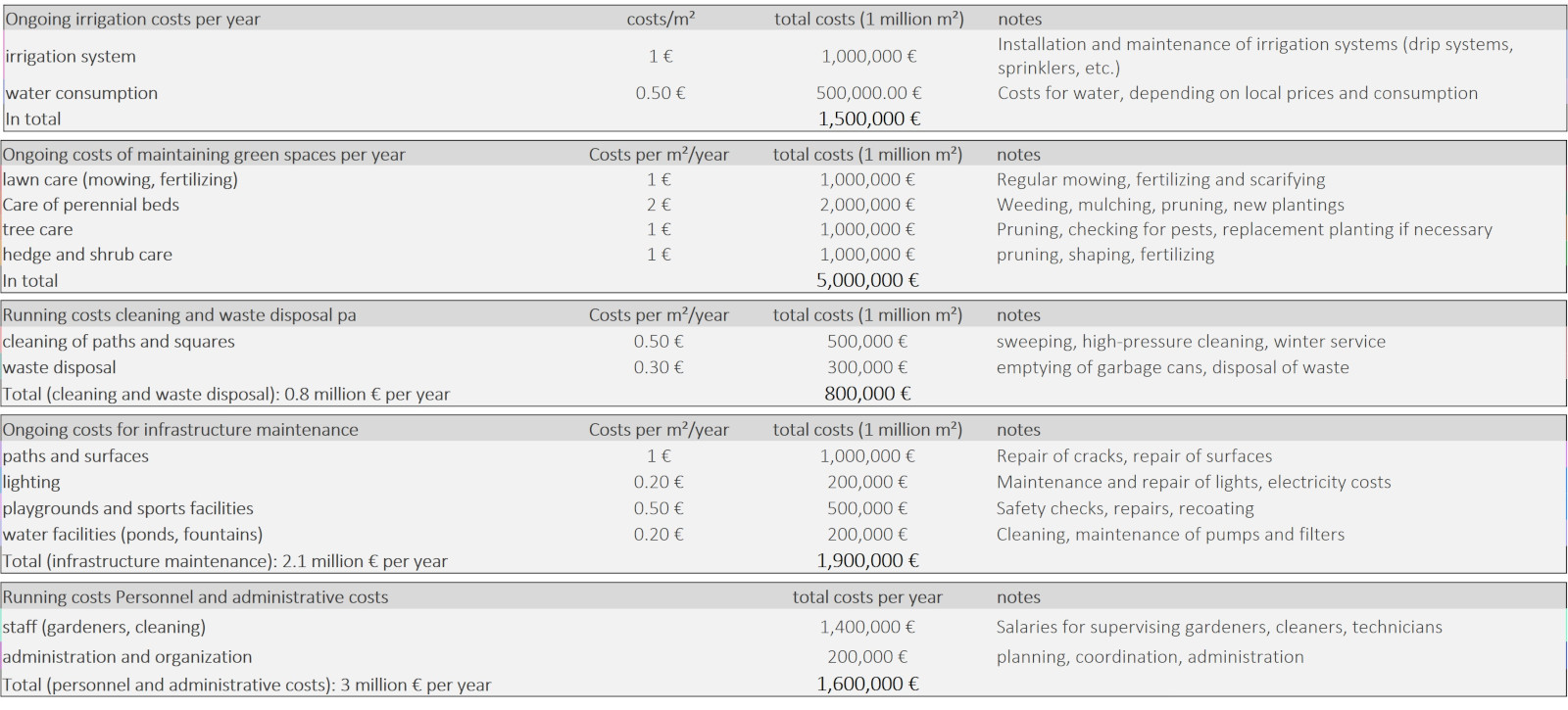

(2) The equivalent value of the green areas on the bridges for the maintenance of a comparable park is around 10 million euros per year , since the sophisticated planted green areas on the bridges are more like a palm garden than a park

For the citizens of the city of Frankfurt, the Frankfurt bridges represent a natural experience right on their doorstep. The area is more than three times as large as Grüneburgpark. With therapy gardens, cottage gardens, urban gardening areas, wild meadows, inclusive playgrounds, sports areas, countless fountains, etc., the area is also more exciting and sophisticatedly planted than Grüneburgpark and its maintenance is therefore more comparable to that of the open spaces of the Palmengarten.

(2) The VGF has a turnover of around 260 million per year. In addition, however, it must be supported by the city of Frankfurt with an average of 100 million per year

It is difficult to calculate the "relief value" of bridge traffic for the city of Frankfurt. If one takes the number of passenger journeys as an indicator, the journeys on Frankfurt's bridges correspond to around 25% of the journeys of the VGF. However, this is unlikely to represent a relief of the existing capacity, but rather saves the VGF from having to build and operate additional capacity - because in the long term, public transport (such as local passenger transport on bridges) and car sharing (such as the car fleet on the bridges) are to be massively expanded anyway. Of the 100 million euros in support for the VGF, 25% "accrues" from bridge traffic, or better: "is taken over by bridge traffic", so that the transport value for the city of Frankfurt is around 25 million euros per year .

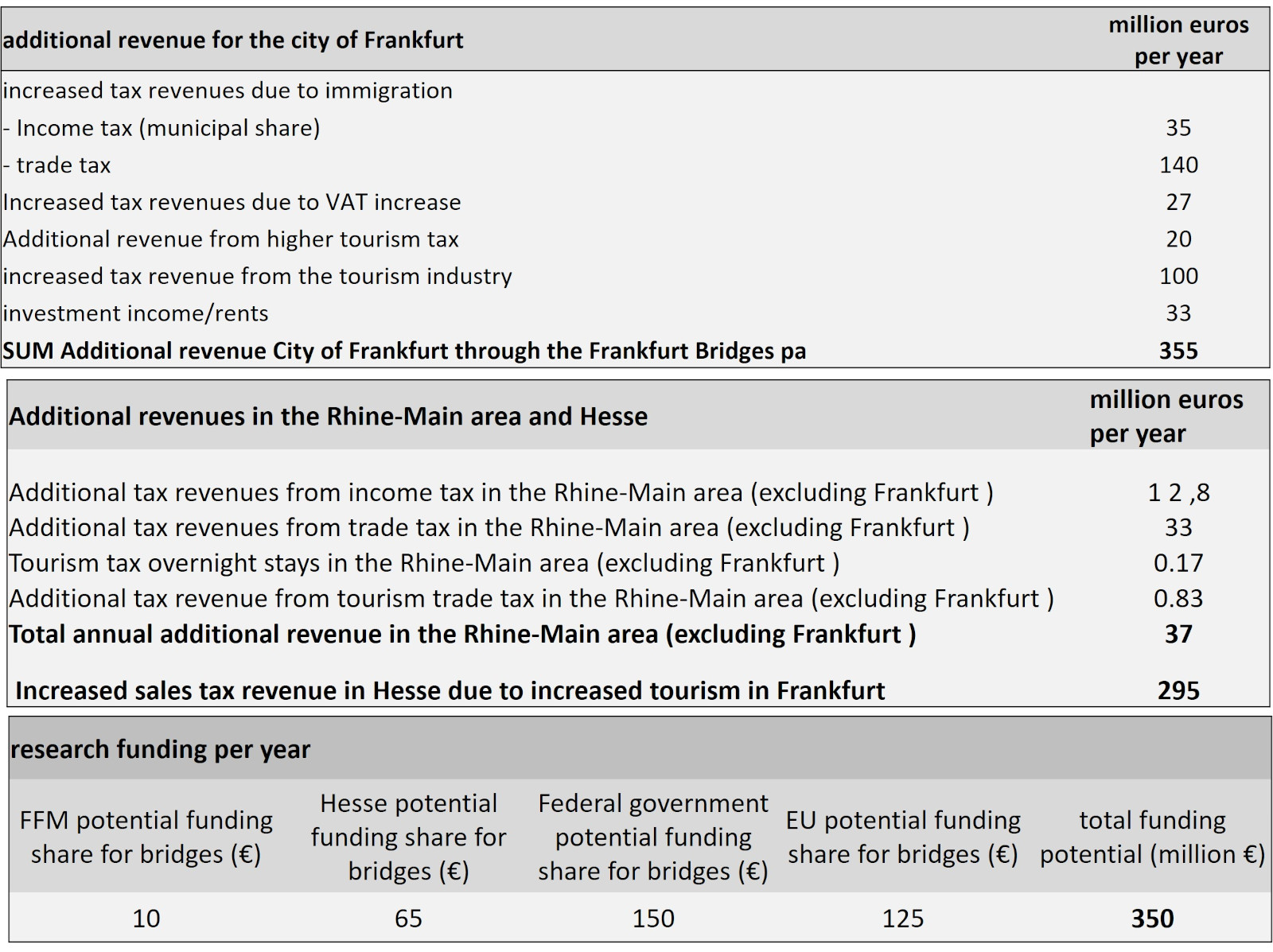

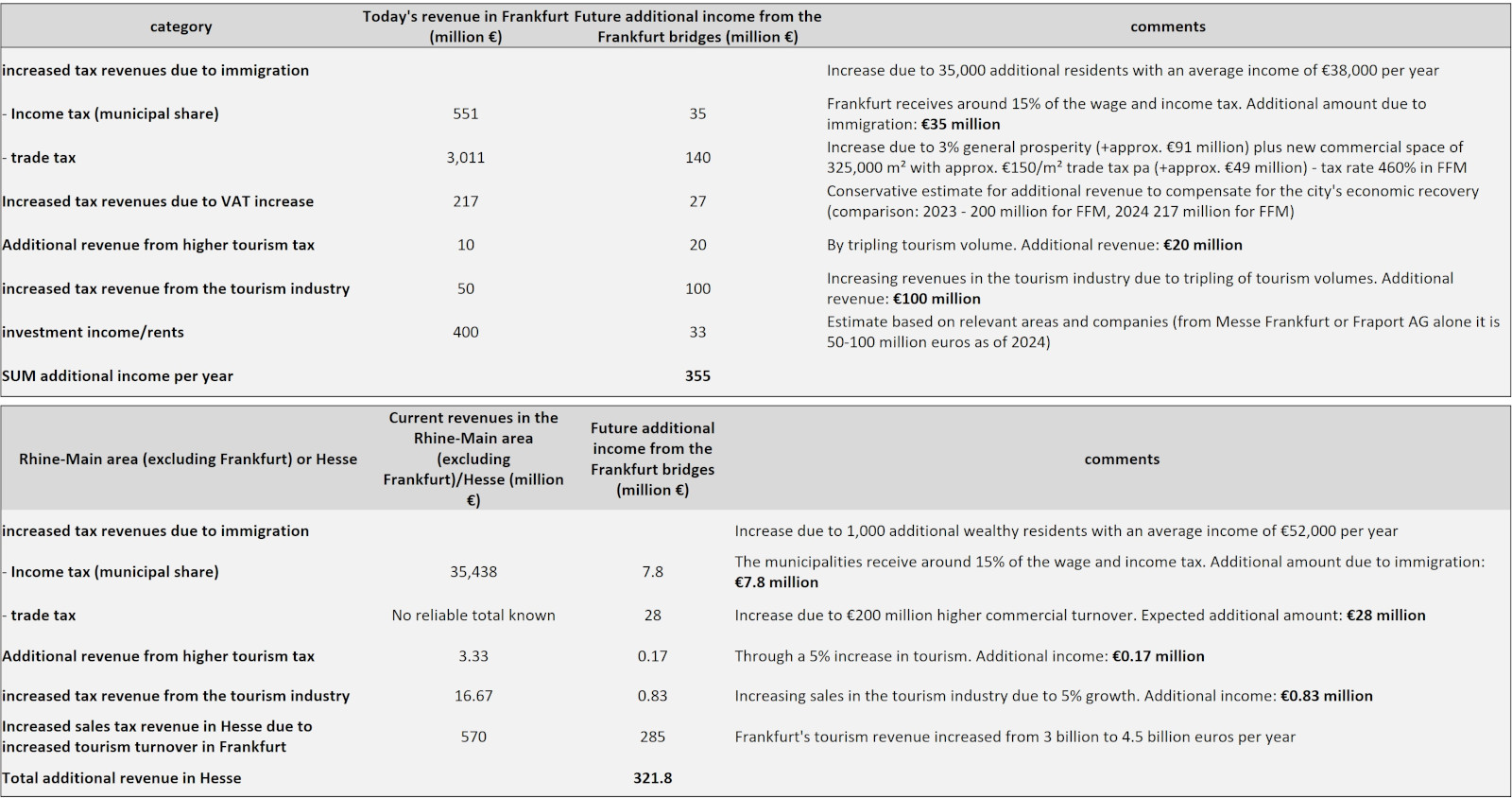

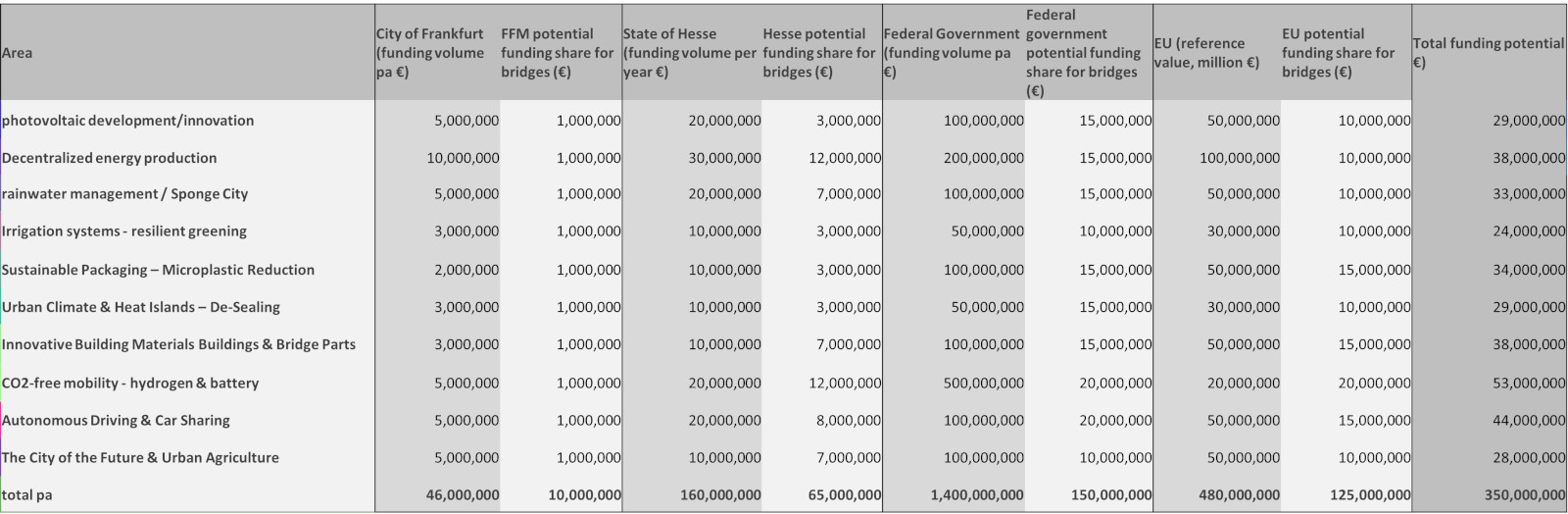

(3) Interest from annual share of additional revenues from the city and state as well as research grants

The Frankfurt bridges represent a significant economic asset for the city, the Rhine-Main region and also the state of Hesse: They are unique - similar to the waterways of Venice - and not only attract millions of tourists, but also lead to a growing population in the city through the increased quality of life in Frankfurt. Their research and innovation character also inspires research and science throughout Germany and Europe.

(to 3) The Frankfurt bridges enable and result in the influx of at least 35,000 new citizens into the city by increasing the quality of life in Frankfurt – the volume of tourism is expected to triple

In addition, the Frankfurt bridges create jobs – through the bridge operating company and for all service providers in the region (the current increased tax rate as of January 1, 2025 has not yet been taken into account in this calculation).

(to 3) The greatest effect felt nationwide and across Europe is the function of Frankfurt’s bridges as a showcase for innovations: whether in the IT college or through innovative legislation on the bridges – they can become the Silicon Valley of Europe

Already today, a lot of funding is being made available at city, state, federal and European levels for innovation, research, start-ups and pioneering projects, which are often not fully utilized because there are simply not enough innovative approaches: both on the part of companies and on the part of municipalities.

The Frankfurt bridges have the advantage that they represent an "exceptional area": you can attend an IT college without any previous school education, you can work without official bureaucracy, there are buildings made of innovative materials where live research is carried out, there is a self-learning autonomous traffic system that is constantly being developed, there is a master academy that serves not only to preserve but also to innovate European arts and crafts, there is a microplastic-free irrigation system and a highly innovative sustainable waste disposal system, etc., etc. Hardly any area of human coexistence remains unexplored on the Frankfurt bridges, so that research funds can continuously be invested sensibly. Innovation and research are part of the DNA of the Frankfurt bridges.

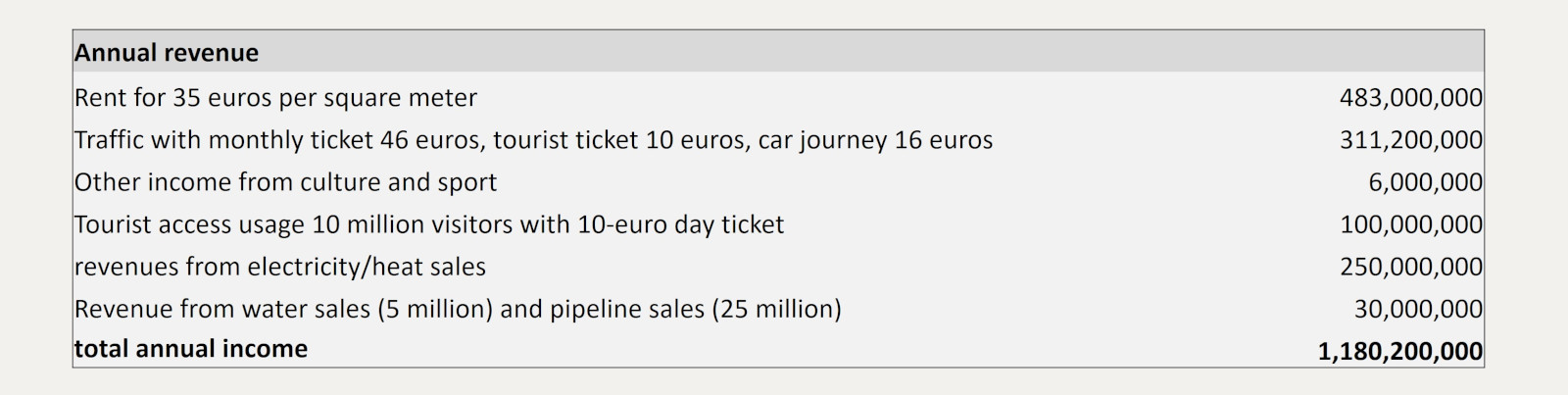

(to 3) Actually, the bridge offer is pure luxury – wouldn’t a highly profitable revenue structure be possible?

If, instead, the operating income were to be used to the maximum for luxury offers by setting the rental price at 35 euros per square meter instead of 9 euros/square meter, the monthly ticket at 46 euros instead of 10 euros/month, etc., the return would be around 5% pa over 85 years (without any increase in value or capital gains). The income would increase, but most of the current state subsidies - with the exception of some research funds - would be eliminated.

Since the operating company only records 210 million euros in surplus per year if it were a non-profit organization, but would generate over 1.1 billion if it were a profit-oriented organization, a profit-oriented organization of the Frankfurt bridges would lead to a higher interest rate (even if the subsidies from the city, state, federal government and Europe were limited to around 500 million in research funding). BUT: With such a plan, it would be very unlikely that the citizens of Frankfurt would approve the development plans for the bridges - the bridges would not be built in the first place.

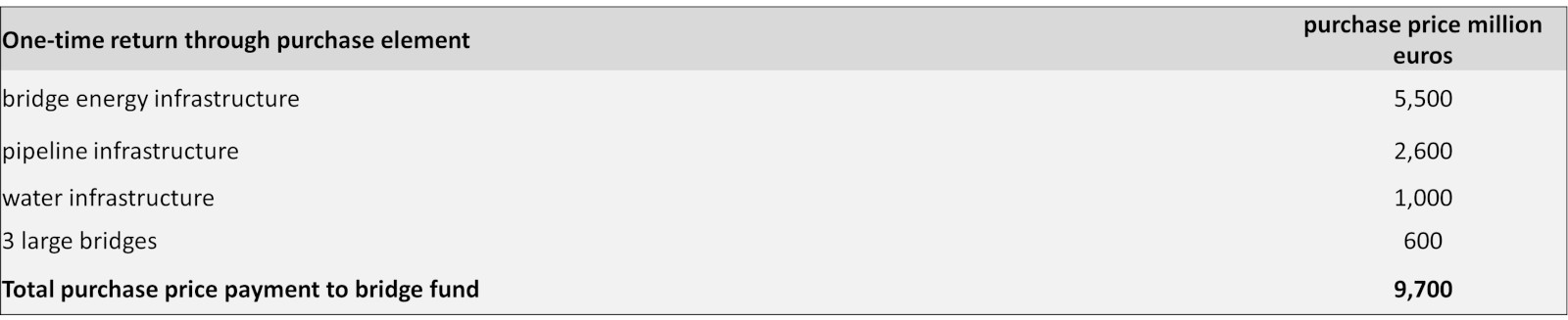

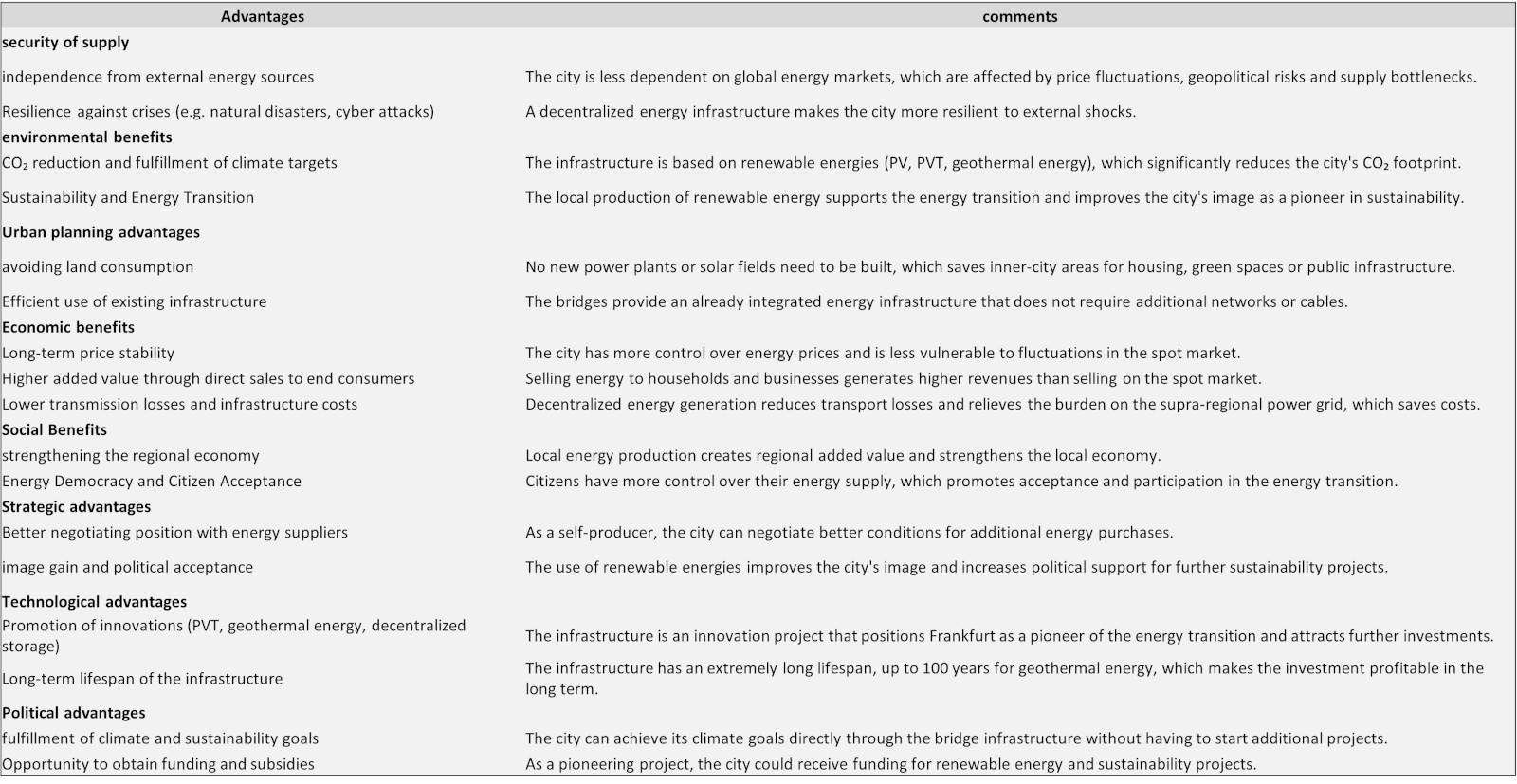

(4) Interest from the sale of the bridge infrastructure: With the purchase of the bridge body including the pipes, Frankfurt will receive a sustainable infrastructure that runs through the city, which it would never be able to build itself without the bridge structure

All major cities have the problem that they find it difficult to implement the urban energy transition within their existing structures: geothermal energy cannot be retrofitted beneath existing buildings, the power grids are not sufficient to transport PV power on a different scale or to set up a complete electricity-based transport and heating infrastructure, and solar heat can only be used in a decentralized manner and close to where it is generated, meaning it is not suitable for supplying densely built-up apartment buildings. With the Frankfurt bridges, however, the city is buying a high-performance infrastructure that can provide a quarter of the electricity to households and - if heat pumps are more widely used in the future - also a considerable part of the heat supply.

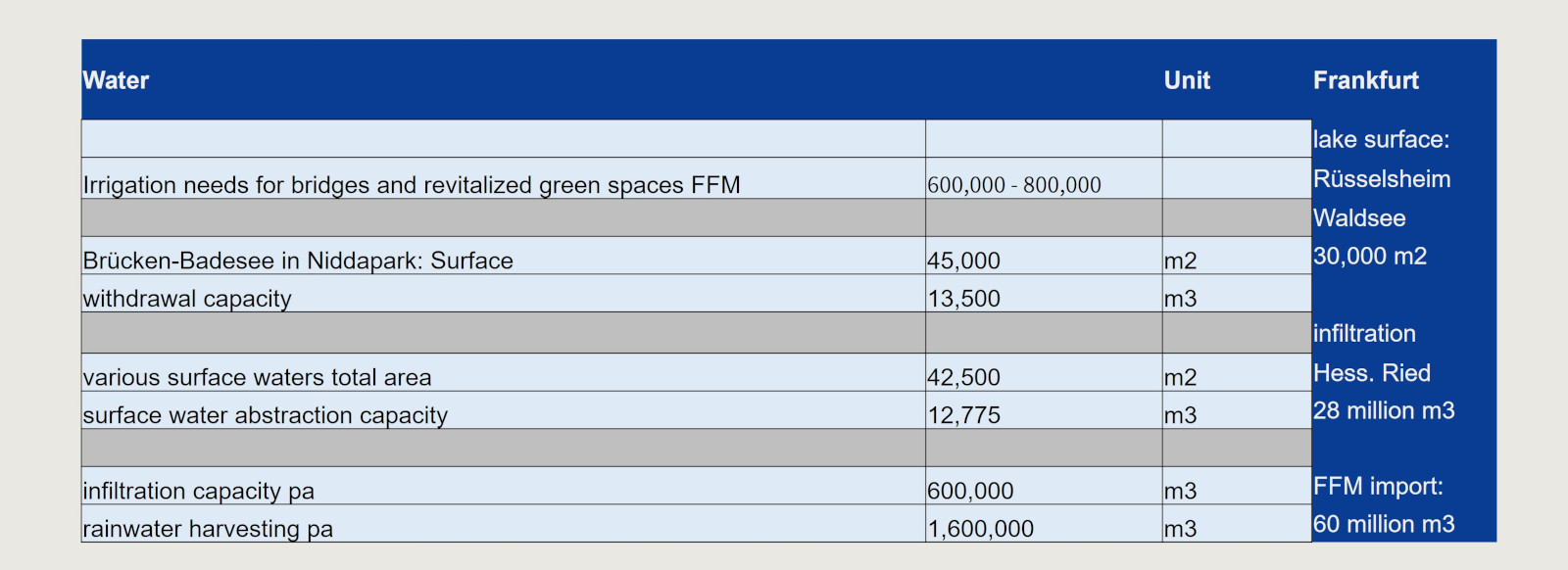

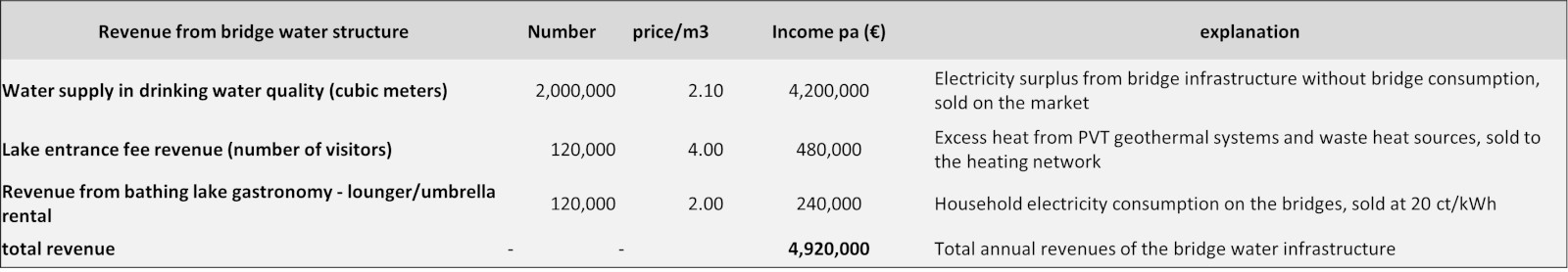

The situation is similar with the water infrastructure: urban green spaces, parks and even the city forest are suffering more and more from drought and heavy rainfall. Emergency watering in the summer is carried out using carts and plastic watering bags on young trees. Here too, the city is buying a high-performance irrigation network with the water infrastructure of the bridges, which it could not install itself in this form and network.

Most cities are at the limit with their underground cable ducts: providers have to pay high prices to be allowed to lay their cables there, and Frankfurt in particular, with its data centers, has a problem here that can be largely solved by purchasing the Frankfurt bridges.

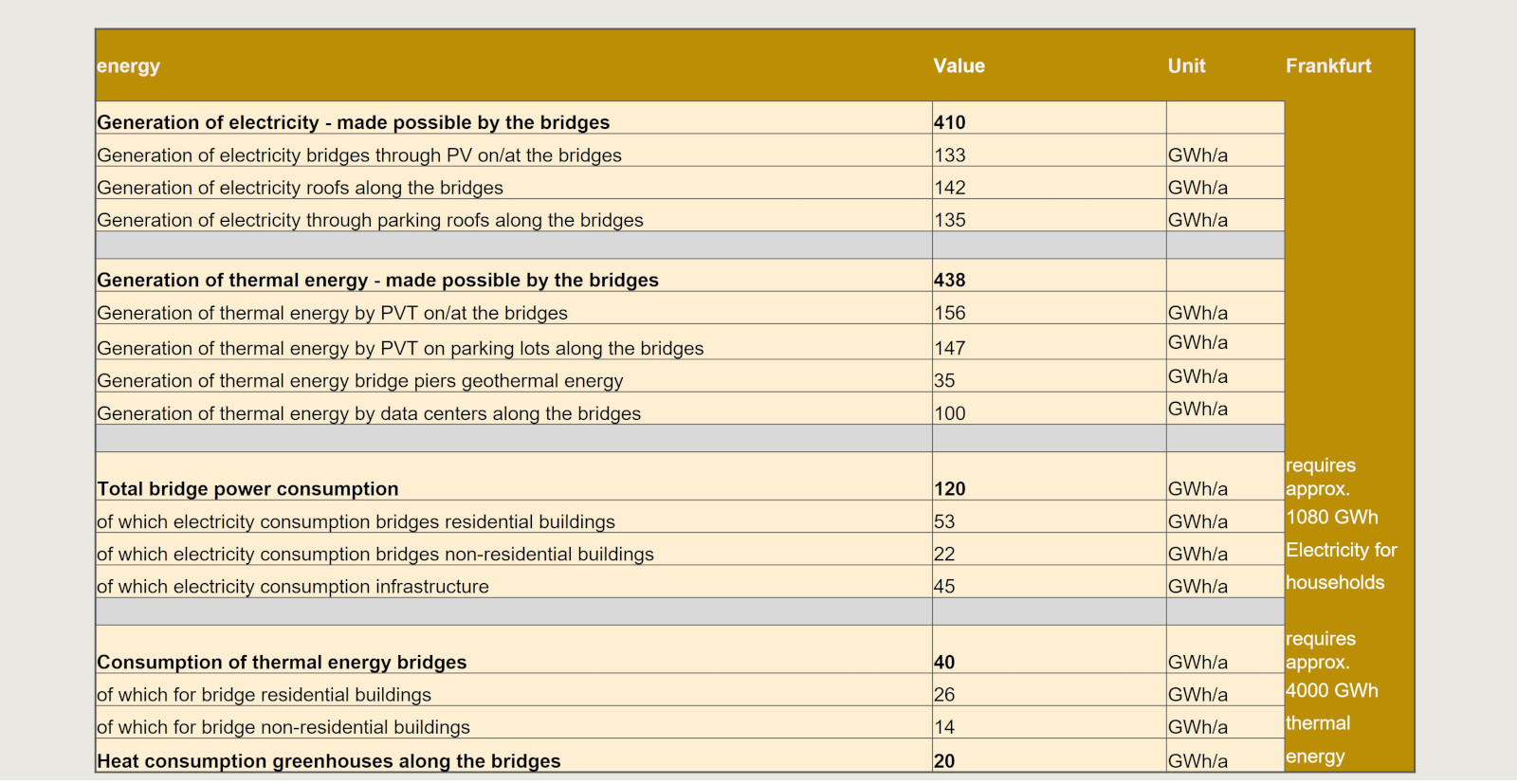

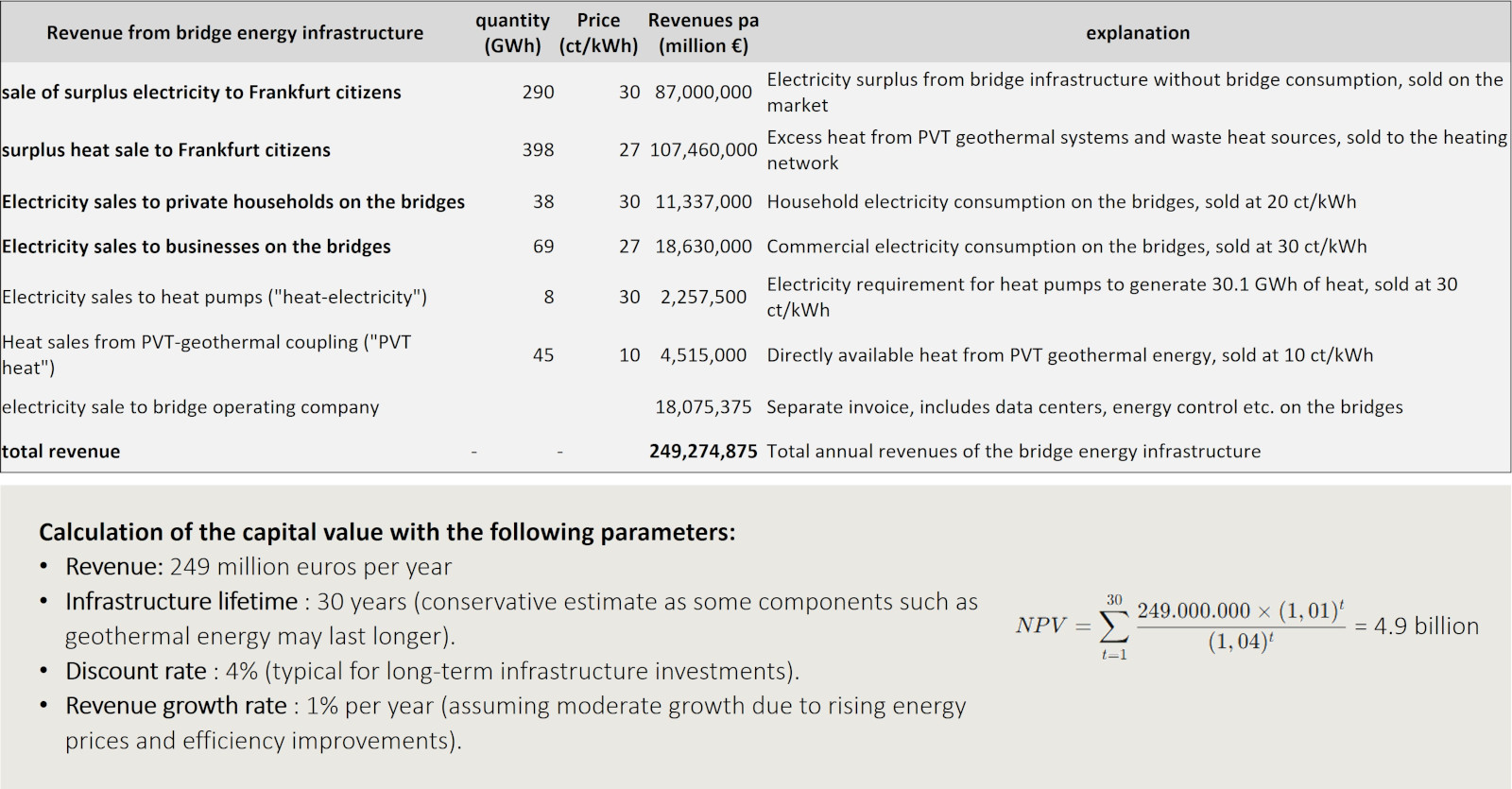

(4) By purchasing the bridge energy infrastructure, the city of Frankfurt can generate electricity for 25% of households and heat for 10% of households

The energy infrastructure created by the construction of the Frankfurt bridges includes photovoltaic and PVT modules on, at and next to the bridges, and a coupled geothermal system along the course of the bridge, which can also integrate waste heat from data centers and sewers.

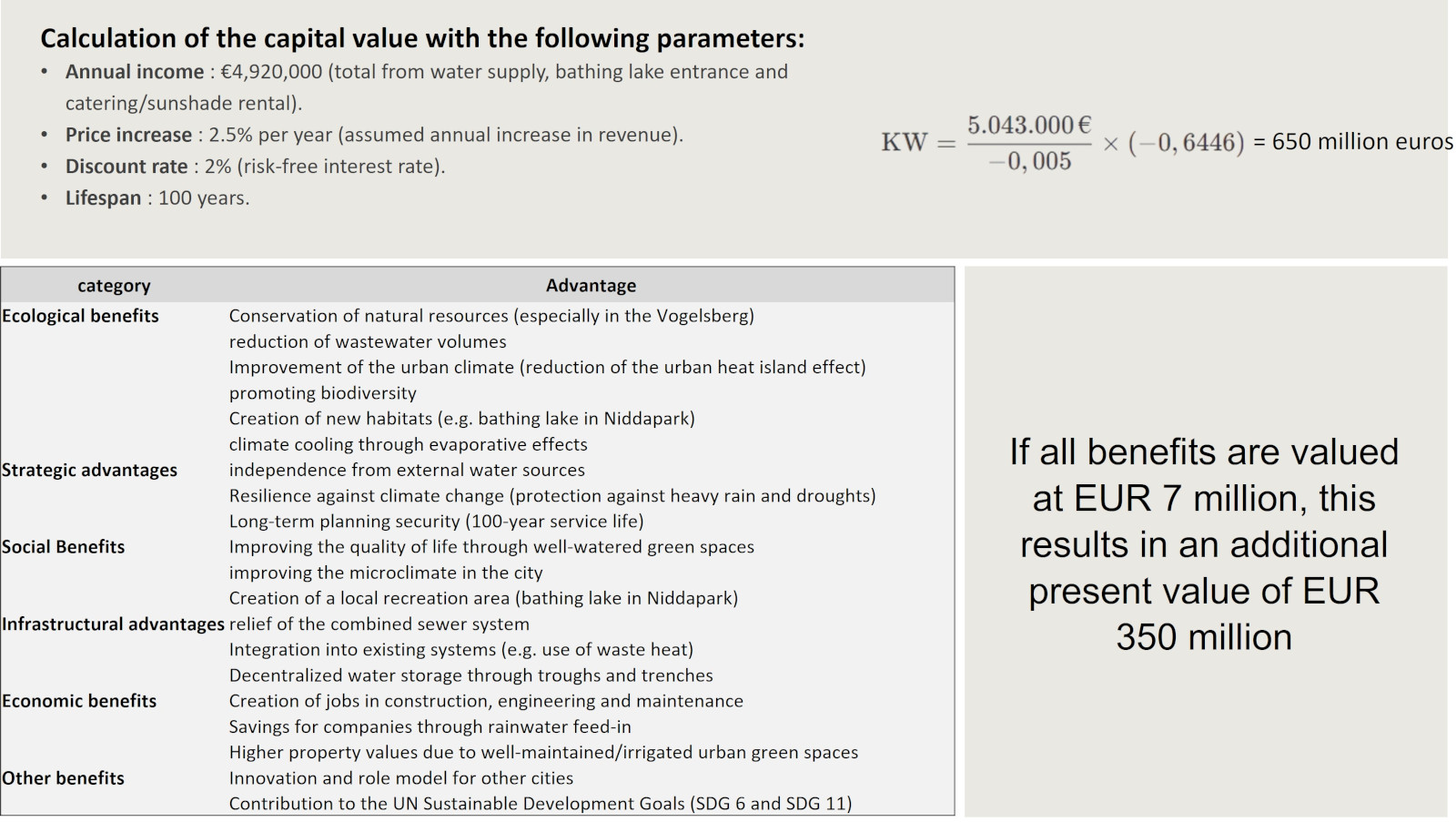

(4) The purchase price for the bridge energy infrastructure is initially to be determined on the basis of the capital value, which amounts to around EUR 4.9 billion

Parts of this energy infrastructure such as PV and PVT modules have to be replaced after about 30 years, but large parts such as the geothermal system have a lifespan of up to 100 years

(4) If the various advantages for the city of Frankfurt are taken into account with a premium of 20% and the risks with a discount of 10%, the purchase value for the energy infrastructure is around 5.5 billion euros.

Both the benefits (see below) and the risks (such as technological changes, political risks or unexpected maintenance costs) are estimated conservatively.

(4) The Frankfurt bridges can collect at least 2 million cubic metres of water, transport it to storage locations and then extract it again and distribute it for the purpose of irrigating their own surface and the city's green spaces

(to 4) The purchase value of the water infrastructure is determined not only by the pure revenue that the city generates from it, but also by the numerous ecological benefits and the increase in the quality of life in the city

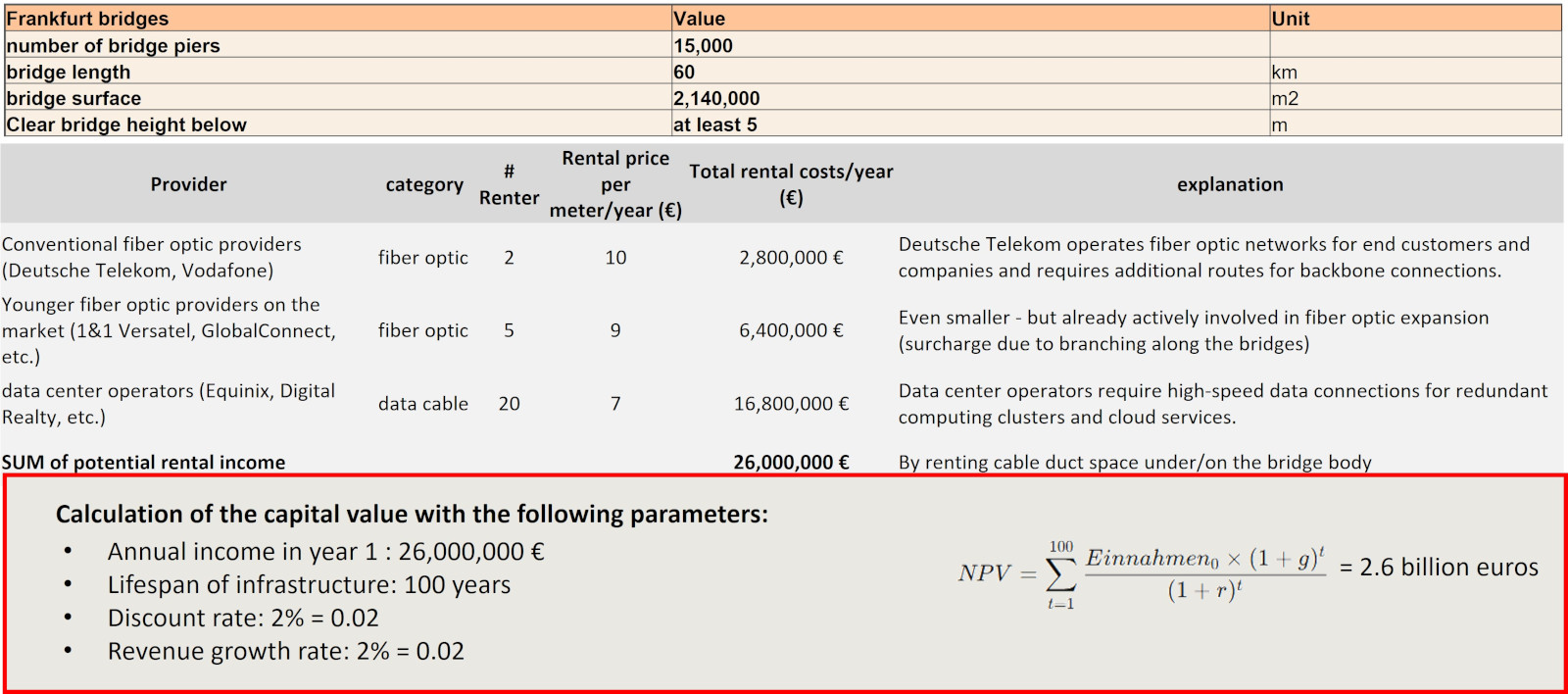

(to 4) The bridge body offers an ideal area to hang cables on the underside and thus lead them across the city – the capital value for Frankfurt is around 2.6 billion euros

Fiber optic and data cables are a rapidly growing segment, and the cable ducts in all cities are full to bursting. To get from one side of the city to the other, large stretches of road would have to be torn up, which is not worth it for the additional cable storage space alone . The situation is different with the bridge body: This has numerous primary functions, but one of its most profitable secondary functions is the fact that large quantities of cable can be laid in and under it. Here, only the lower limit of the potential has been used for the purchase price calculation.

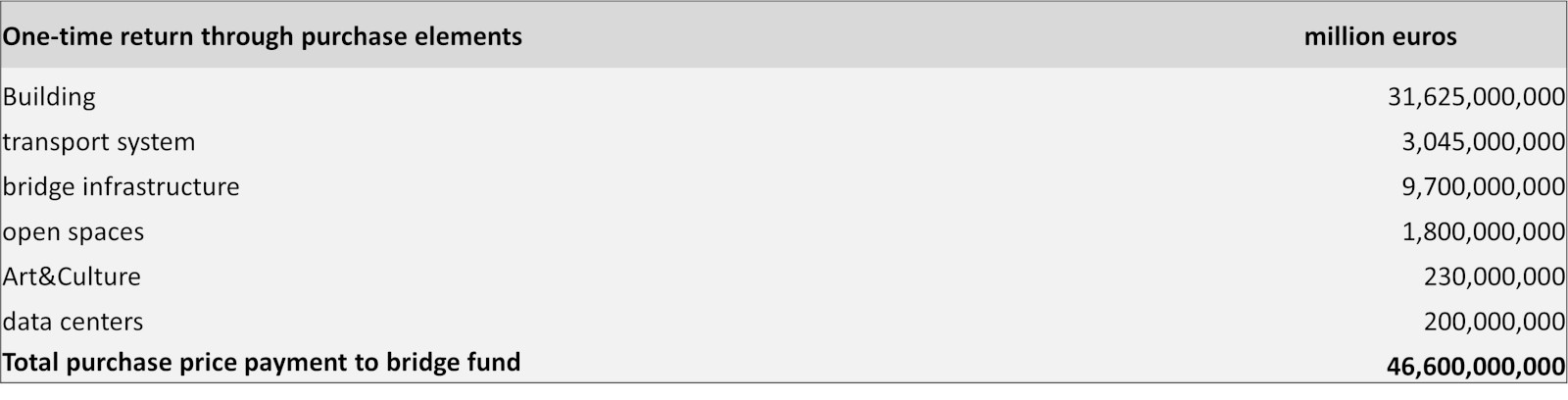

(to 4) Actually, the bridge offer is pure luxury – would it not be possible to sell all of Frankfurt’s bridges at a high profit?

Theoretically, the properties on the Frankfurt bridges could be sold at top prices per square metre of around 27,000 - 28,000 euros/m2, and the transport system, which can generate revenues of up to 300 million euros per year with additional vehicles, should also achieve attractive sales proceeds of at least 3 billion euros. Together with some other sales proceeds, an investment of 23 billion by private investors over 15 years, with sales proceeds in the 16th year of 46.6 billion, would result in an investment with a return of around 8% if sold immediately after completion.

But without the use of the buildings for affordable housing, without affordable local transport, without an inclusion offer in sports, art and culture, the subsidies from the city, state, federal government and EU for the construction would not be as high (10 billion in the current planning), and the return on investment would thus fall to a much less attractive 4% - 5% pa. And there would be no acceptance for the construction of the bridges.

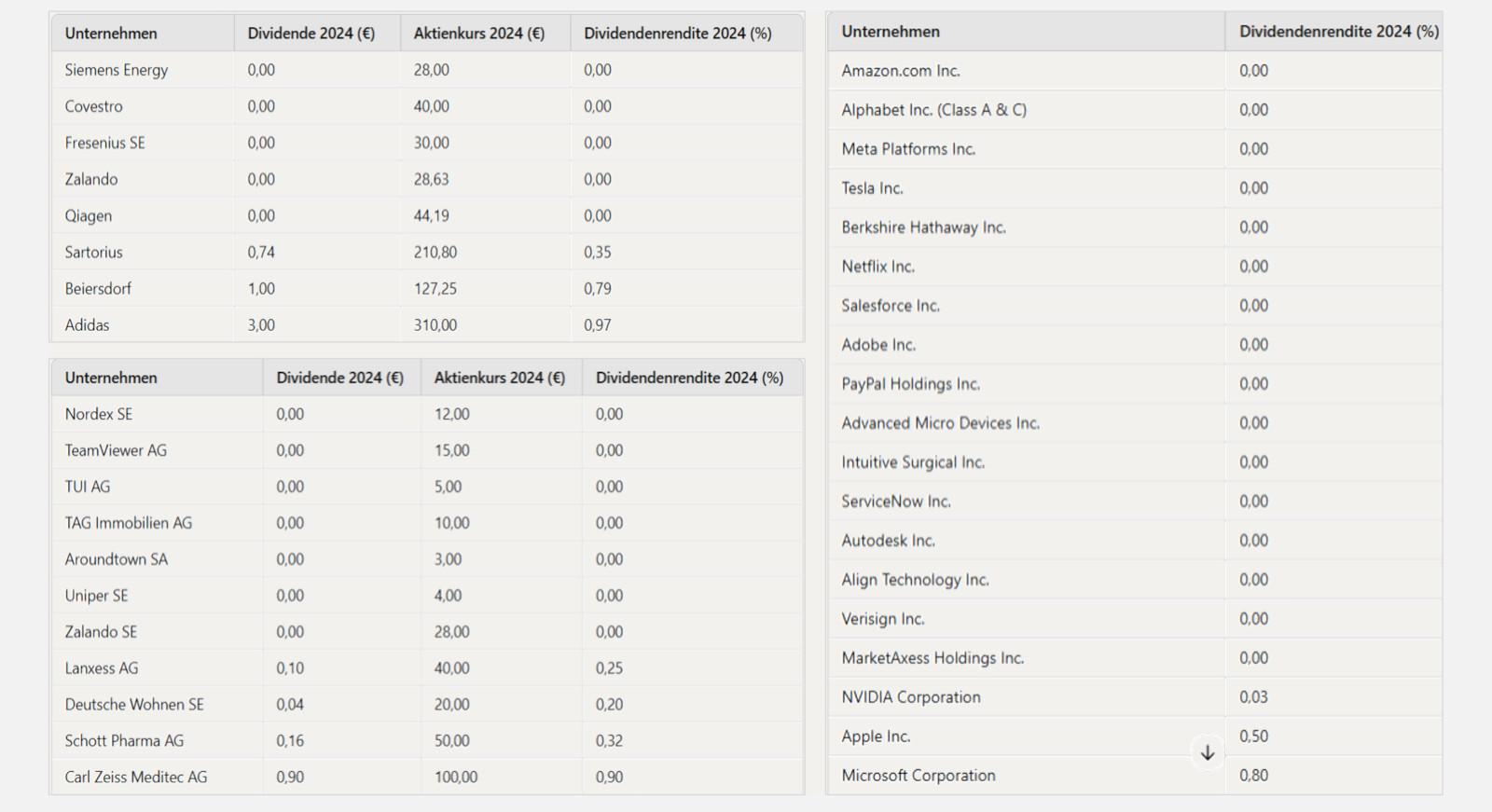

The annual interest rate on the Frankfurt bridges through income from the operating company, savings and additional income from the city and state as well as research funds from the federal government and the EU is around 2%-3% per year - significantly higher than many dividends

The returns from annual price gains on the Frankfurter Brücken, on the other hand, are between 5% and 15% depending on the phase of the investment period and thus tend to be lower than many share price gains – which, however, are also riskier

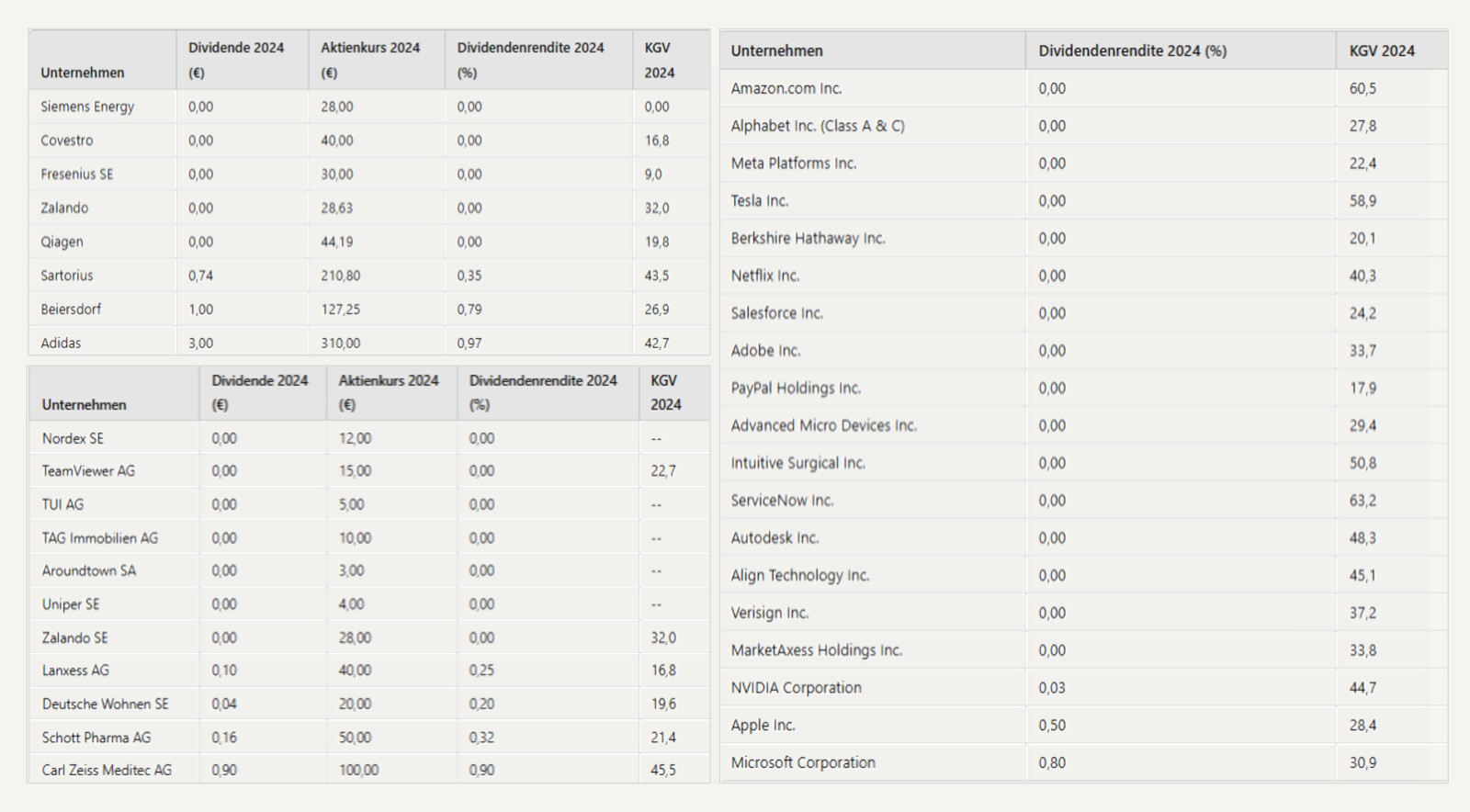

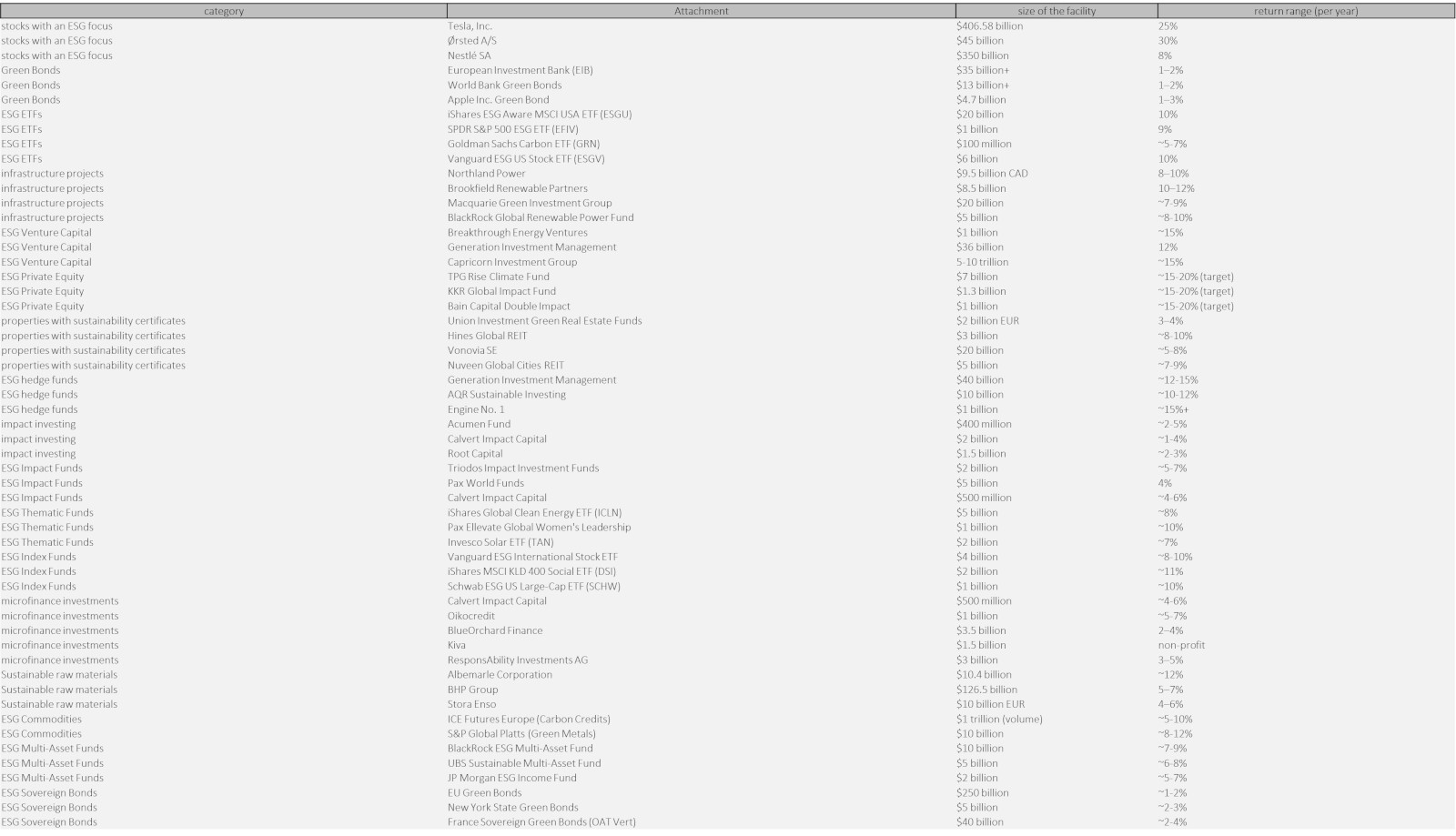

The Frankfurt bridges have to compete with other ESG investments that generate attractive returns due to subsidies - the interest earnings of the bridge fund should therefore be tax-privileged, as is the case with many ESG investments

Until the Frankfurt bridges are sold 85 years after their completion, a moderate but risk-free interest rate can be achieved: However, the investment only becomes really attractive when all interest gains up to the time of sale are significantly tax-privi

Until the Frankfurt bridges are sold 85 years after their completion, a moderate but risk-free interest rate can be achieved: However, the investment only becomes really attractive when all interest gains up to the time of sale are significantly tax-privileged – justified by the ESG impact of the non-profit operation

In the present schematic rough estimate of interest rate expectations for the Frankfurt Bridge Investment, some potential value-enhancing levers for the 85 years of operation have not yet been taken into account

Over the course of the 85 years of operation of the Frankfurter Brücken before the transfer of ownership to the owner, the GmbH&CoKG Brückenfonds, the market value of the Frankfurter Brücken investment can still increase significantly through a number of potential measures:

- The Frankfurt bridges could be built more densely than is currently planned, especially at the ends of the bridge arms. Currently only around 24% of the bridge surface is built on, so buildings could be constructed for another 100,000 to 150,000 square meters of residential and commercial space.

- The ends of the bridge arms could be extended to reach even more distant parts of the city or suburbs. Since 90% of the route would be on motorways and country roads, significantly higher buildings could be built on the bridges instead of the currently assumed average number of 2.5 floors per building, which would result in an additional 1.5 to 2 million square metres of building space. The bridge fund could make the investment itself or collect a licence fee for the extension.

- Likewise, planning elements of the Frankfurt bridges can be sold to potential imitators abroad.

- If traffic volumes on motorways and country roads decrease over the next 100 years, so that previously 5- or 6-lane roads are reduced by 2 to 3 lanes, this area under the bridges could be developed as building space, for which the bridge fund could also be granted a royalty fee.

All of these points can already be defined in the concept planning and offer significant speculation potential for the market value of the Frankfurt Bridge Investment in the long term.

The present schematic calculation shows that the risk-award interest rate is higher at the beginning (with a holding period of 5 or 10 years for planning and construction) and the reward interest rate also increases more strongly at the end

A 100-year forecast takes many factors into account, which lead to different results in detail depending on how the parameters are designed. But what all considerations have in common is that the Frankfurt bridges represent a low-risk, attractive ESG investment, even with a moderate trend. The value assessment of the bridge surface, which can be profitably exploited after 100 years, offers the greatest range of speculation in the forecast.

Conclusion: With the financing concept of the Frankfurt Bridges, it is possible to combine a private ownership structure that ensures efficient planning, construction and operation with a non-profit orientation of the project and at the same time ensure an attractive return structure for investors.